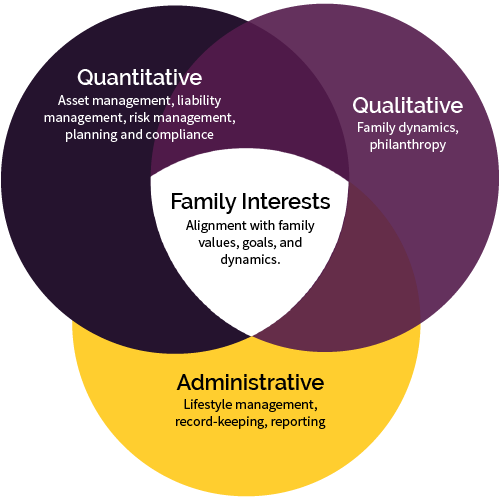

At Three Bell Family Office, we work with our clients’ extended team of advisors to serve as an outsourced Family Office, coordinating not only asset management, but intergenerational wealth transfer, complex charitable planning, integrated tax strategy, and risk management, in a way that preserves your family values as well as your wealth.

Family Office

FULLY ALIGNED FAMILY OFFICE

Legacy Planning

Estate planning, by itself, is insufficient to protect wealth over multiple generations. The statistics support this with 70% of family wealth lost by the 2nd generation and 90% lost by the third.

We work with your family to align assets, estate plans, and charitable structures with your values to ensure the next gen is well prepared to be stewards of your family’s wealth.

Comprehensive Reporting

Peter Lynch famously said, “Know what you own, and why you own it.” However, that becomes increasingly difficult as investments become more numerous and complex.

Our sophisticated software systems allow all of your assets to be tracked and organized in a way that increases visibility and enables better decision making. In addition to performance reporting, we also provide cash flow analysis, tax estimation, P&L, and balance sheet reporting.

Expert Coordination

Family Office clients have an extended network of advisors that range from accountants to attorneys, each touching and influencing clients’ financial lives in a significant way.

We coordinate these professionals’ efforts according to a family wealth plan designed to keep all the horses pulling the carriage in the same direction in a logical and process driven manner.

Asset Management

Investments for Family Office clients go well beyond traditional investment portfolios.

In addition to providing more institutional, endowment-style alternative investment portfolios, we assist clients manage a wide variety of other assets, including real estate, aircraft, yachts, and collectibles like art and automobiles.

Liability Management

The amount and types of insurance a Family Office needs vary dramatically from less affluent families.

We will work with our extended network of insurance providers to design and implement a comprehensive insurance strategy that protects your family through the use of permanent and private placement life insurance, umbrella coverage, concierge medicine, as well as well as home, auto, yacht, aircraft and collectibles policies.