Inflation’s UP and DOWN 2-step…

NO RETURN TO THE 1970’s….Inflation is likely to cycle UP and DOWN over the next year.

In 1980, US inflation peaked at a bit over 14%, which pushed home mortgages to 18%. Let that sink in. While you’re at it, enjoy these flashbacks from circa 1980:

- Studio 54 was ramping up and closing down with the Disco craze

- AC/DC was the top rock band in the US, while Queen topped the charts globally

- MASH was the most popular comedy, while JR Ewing and Dallas provided the most hated character on the most loved show on TV. In fact, Dallas reflected the boom and bust of the energy crisis that created gas lines.

- Dustin Hoffman starred in Kramer vs Kramer, which won the best picture and best actor that year.

- In the sportsworld, the Pittsburgh Pirates won the World Series (We Are Family) and the Pittsburgh Steelers won the Superbowl (perhaps marking the end of steel’s dominance).

- The Rubix cube was the most popular toy (I never completed that damn thing, but my kids did) and the artificial heart was invented.

At the very core of our soul as a nation, the Iranian hostage crisis dominated the news that allowed for our inflationary fears to further penetrate our collective consciousness. The late 1970’s-early 1980’s saw real inflation that fed real financial and geopolitical anxieties.

Why am I waxing nostalgic you ask? Perhaps because I just bought a new turntable and nothing stirs up memories and emotions like spinning vinyl. I strongly recommend it. It all seems to ‘crossover’ (audio speaker term) well with the increasing inflationary chatter we hear today.

In case you are wondering what inspired the blog picture above, look no further than this 1978 “Head East” album cover of mine…

Don’t get me wrong, our economy is currently steam rolling out of a pandemic-induced low inflation base, which helped to crater prices. In that regard, we will likely see notably higher prices over the next 6-12 months OFF A VERY LOW BASE.

This will be transitory (FED speak for temporary) and reflects the economy working through pandemic induced supply cutbacks/bottlenecks with excess stimulus dollars. This will soon pass, like a concert tour, and we will find ourselves back in the familiar +/-2% inflation environment that allows for low and stable interest rates.

As such, the markets may be spooked by a few outsized inflation prints over the next several months, but we view that as more of an opportunity to buy on pullbacks than totally repositioning our portfolios and creating taxable events.

In fact, I note that the US 10 year Treasury yield hit 1.64% back on March 12th, which is the same level at which it sits today. Over the same time period the S&P 500 has risen from 3940 to 4160. This all happened while we got news of the cyber attack on the Colonial Pipeline on the east coast, which has led to gas hoarding AND a shocking April CPI print of 0.8% and 4.2% (year over year). That monthly number was 4 times what was expected. Yet the market has handled this news in stride… it is just the NEWS and financial pundits that have reacted in a frenzied psychedelic fashion.

Now, to lay out some of the differences between 1970’s inflation and what we are observing today, I would like to take a bit of poetic license from the 1979 Talking Heads track “Life During Wartime”…

This Ain’t No Party, This Ain’t No Disco, This Ain’t No Wage Inflation

There are major differences between the two periods, but yet many in the financial press want to stretch the similarities. We will try to highlight the contrasts below in another edition of “Cutting Through the Noise”.

The 1970’s period seemed to blend fond and experiential memories with times of uncertainty on the cusp of chaos. What a ride that all turned out to be culminating with the crippling inflation of the late 1970s and early 1980s, right up until Paul Volker broke its back with 20% money market rates.

Those high interest rates then helped to set the stage for the era of the Yuppies, Bimmers, and Gordon Gecko’s “greed is good” mantra on Wall Street throughout the mid to late 1980’s.

A little more background and context… that entire inflationary period began in the early 1970’s with profligate spending to end the Vietnam War, which occurred just as the US was abandoning the gold standard, when the US Dollar was no longer affixed to its equivalent in gold. As if that weren’t enough, OPEC was busy fixing the price of oil at exorbitant levels, which only drove prices and fears higher. It was a perfect storm.

Abandoning the gold standard meant the FEDeral Reserve was still early in its learning curve to navigate the ways of their own open market operations back in the 1970’s. They had relatively little comparative experience in using their new ‘toolbox’ to manage money supply and inflation expectations.

By comparison, today’s FED has a tricked-out tool box and is operating in an era that doesn’t rhyme with that prior period any better than a poorly written ABBA lyric.

By comparison, today’s FED has a tricked-out tool box and is operating in an era that doesn’t rhyme with that prior period any better than a poorly written ABBA lyric.

We are not about to drift back into that 1980’s wilderness. Big out breath. I wholeheartedly believe that the biggest mistake investors have made over the past 40 years is fearing the return of inflation.

In fact, over the past 40 years, the significant secular driving forces of inflation have been:

- Technological advancement that produces productivity gains that far outstrip inflation

- Globalization of the workforce, which has exerted downward pressure on wages

Most other demographic and potentially inflationary factors are smothered by these two forces. And when considering those major forces rationally, we begin to discount inflation as a small and manageable outcome. Are those forces at risk of reversing anytime soon? I think not, especially technological advancement.

It is important to remember, inflation is not something that automatically cycles like the seasons or shows up randomly on a black jack table. Inflation is the result of monetary inputs and our collective response to those inputs.

Perhaps the most comforting factor is that now the FED has many methods and instruments to monitor and control those inflation inputs. And they work.

Is This Woodstock or Altamont?

One of the FED’s most notorious new instruments is their Quantitative Easing program, which was designed to manage interest rates lower and thereby incentivize investors to take more risk. To this point, that program has been wildly successful in accomplishing its primary goal. We’ll call it early days at Woodstock.

The FED has successfully managed interest rates lower by buying bonds and driving up the prices of asset values almost across the board. The questions then became,will this program stoke rampant inflation or will it eventually need to be reversed and deliver a bottomless deflationary spiral?

On the first point, I will admit that I was one of the early to cry wolf in early 2009 and call out the QE program as inflationary. However, after learning about some of the FEDs other new tools designed to offset the inflationary impact of QE (which will be discussed below) I reversed track and now see the path to much more manageable inflation and interest rates going forward.

In fact, having managed inflation assets for almost 30 years, which allowed me to meet with Central Bankers and FED Governors/Presidents of all stripes, my collective observations and experiences lead me to believe that a much bigger fear is deflation, not inflation. This will become increasingly more clear with each successive recession… a topic for another day/blog.

However, once again investors and many in the financial press appear wary that all the reserves created through the QE (Quantitative Easing) program will now come home to roost and drive up inflation; thus reversing all the positive effects of QE and wiping out all our glorious gains. Welcome to the Altamont free concert!

However, once again investors and many in the financial press appear wary that all the reserves created through the QE (Quantitative Easing) program will now come home to roost and drive up inflation. Thus, reversing all the positive effects of QE and wiping out all our glorious gains. Welcome to the Altamont free concert!

The biggest culprit for most of the unfounded inflationary fears out there is born from mis-understanding the FEDs QE (Quantitative Easing) operations and the mis-perception that the FED is “printing money”.

ASIDE: I want to mention that the FED has driven asset price inflation. This is irrefutable. However, that is not the topic of this blog. We have covered that in previous blogs. This blog is specifically geared towards goods and services inflation. It is that type of expected inflation that will likely drive interest rates and asset prices into the future.

I Can See Clearly Now…

Let me make this as simple as possible… the Fed is not printing money – at least not in an inflationary fashion. What the FED has been doing is buying US Treasuries and agency mortgages, which creates reserves on private sector bank balance sheets. Those bank reserves are credited when the FED pays for QE bond purchases. Those reserves certainly have the potential to enter the M2 money supply through bank loans, but so far we have not seen that happen to any significant degree. *M2 money supply includes cash and checking accounts, savings deposits, money market securities, certificates of deposit (CDs) and mutual funds. It is the broadest measure of money supply and the indicator most closely watched by the FED.

Those bank reserves are either held in required reserves (considered a part of the monetary base), which can NOT be used to make loans, OR held in excess reserves, which CAN be used to extend credit and thereby increase the M2 money supply.

It is the money that is held in accounts after being extended credit that enters the M2 money supply, which creates inflation fears. The money sitting in required reserves or in vaults is relatively harmless from a ramping of inflation perspective.

I think this is the big disconnect. Most people hear the FED is printing money and do not realize this next tool can largely neutralize those reserves from becoming inflationary.

IMPORTANT: The FED can raise the rate it pays to banks on their excess reserves, in order to disincentivize the banks from making loans, thus keeping those reserves from entering M2 money supply. This is a key component to preventing QE activities from creating hyperinflation.

IMPORTANT: The FED can raise the rate it pays to banks on their excess reserves, in order to disincentivize the banks from making loans, thus keeping those reserves from entering M2 money supply. This is a key component to preventing QE activities from creating hyperinflation.

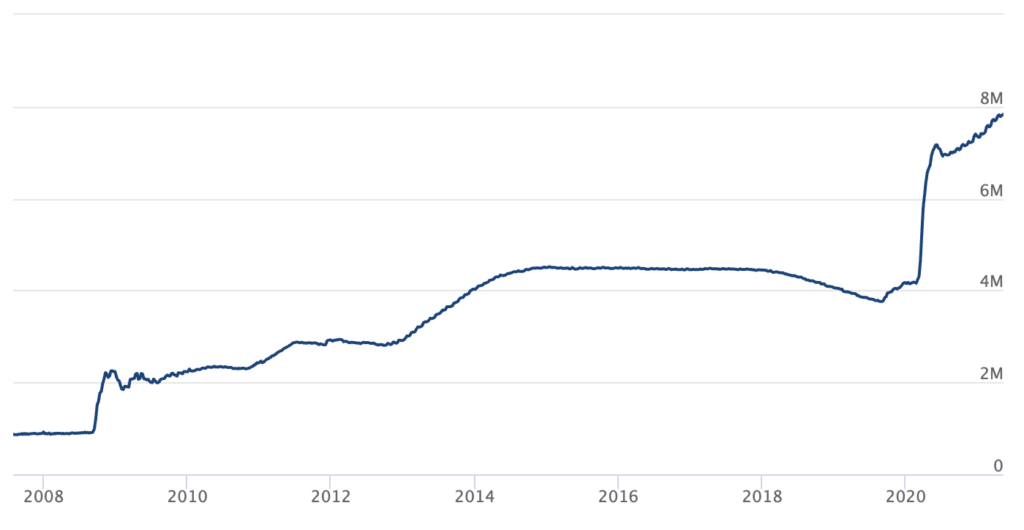

The level of assets (purchased bonds) the FED holds is identified in the chart below. The growth in the FED’s balance sheet is a byproduct of their QE program. Importantly, at this stage, QE operations have largely just created reserves, not net new loans that would drive the M2 money supply.

Total Federal Reserve Assets

Source: FederalReserve.gov

Do we really think the Central Banks from Japan, Euro, US and China could print money until running out of ink without experiencing inflation… but NOW rampant inflation is just around the corner? I’ll be gentle…it isn’t.

In the grand scheme of things, our FED’s asset buying program appears tame compared to Japan, Europe, and China. And keep in mind, the Bank of Japan has been at this a lot longer than we have and they still fear deflation, not inflation.

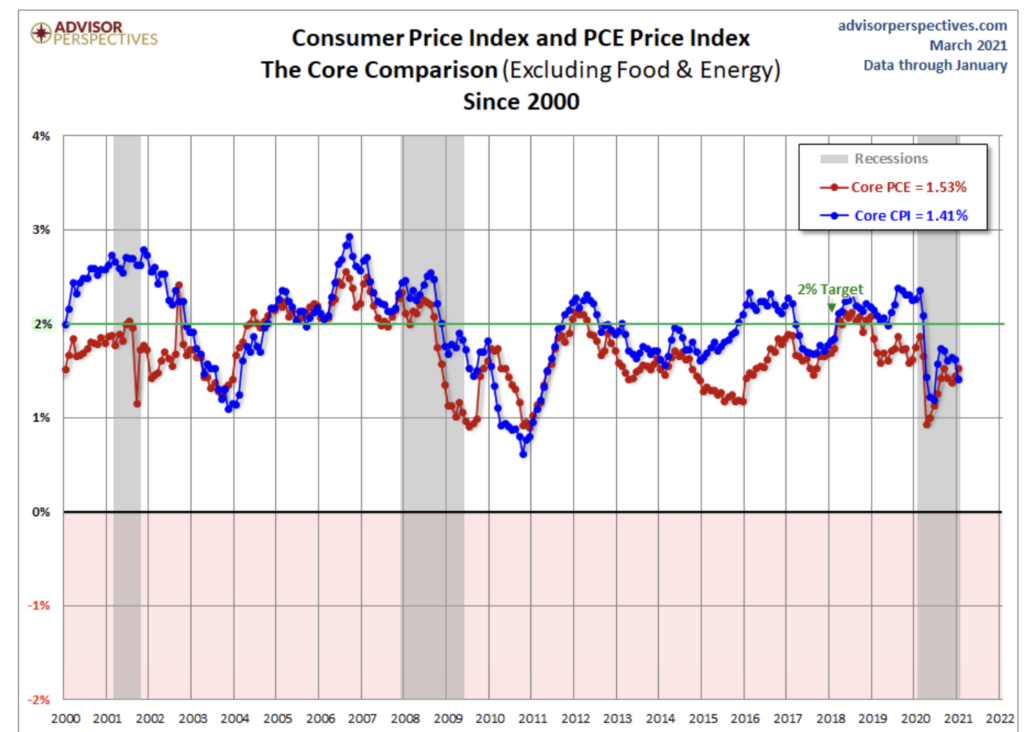

NOTE: I want to make this clear, when we talk about inflation, we are talking about what the FED studies when they gauge inflation. That is the Core-PCE chart below. This does not look at lumber, or oil or food items. The Fed is attempting to strip out items that may be subject to supply disruption, as we have seen during the pandemic.

Keep in mind, the Fed is targeting an “average” of 2% inflation through a full cycle. That means they should be willing to tolerate periods of “above” average inflation to offset the periods of below average. Nonetheless, they have the tools necessary to keep that 2% average firmly in grasp.

An Oldie, But A Goodie –

When discussing this topic I always like to quote the respected monetarist economist, Milton Friedman, who once said that “Inflation is always and everywhere a monetary phenomenon.” So let’s look at monetary influences in the market today… an old standby for evaluating inflationary threats.

Getting to the “inflation creating actions,” I once again want to say that the FED is not printing money. They are buying bonds and depositing the reserves on bank balance sheets. That is all quite manageable from an inflation perspective until and unless the banks decide to make loans with their excess reserves. And to a large degree that has not yet happened.

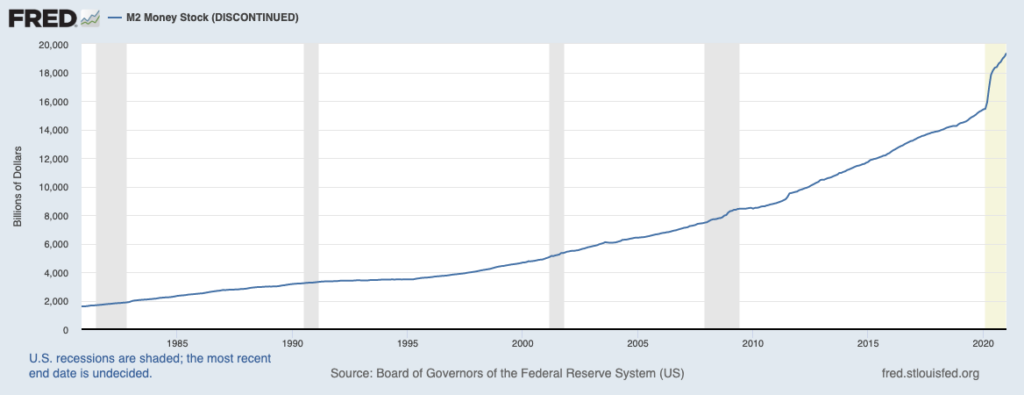

We can see in the chart below that the M2 money supply has actually grown relatively smoothly and roughly in line with what is necessary to fund nominal GDP, or approximately 6% per annum over the past 40 years.

The M2 money supply is important because it represents the amount of money in circulation and in accounts in different forms that can keep the economy moving. The M2 money supply can be used to make loans or settle transactions. Making loans increases the money supply, due to the monetary multiplier effect through fractional reserve banking, which can trigger inflation.

This is why the FED watches the M2 money supply and loan creation so keenly. Those reserves that they created and put on the banks balance sheets are the tinder for potential inflation. So, if those big QE purchases had all been used to make loans and extended as credit, then we would see big jumps up in the M2 money supply (below), that would magnify the jumps in the FED’s balance sheet in the chart above. But we don’t.

The only significant kink in that M2 money supply curve below does not appear until the recent stimulus checks “goosed” the M2 growth rate during the 2020 pandemic. You see the most pronounced kink in the curve starting last year. Should we worry?

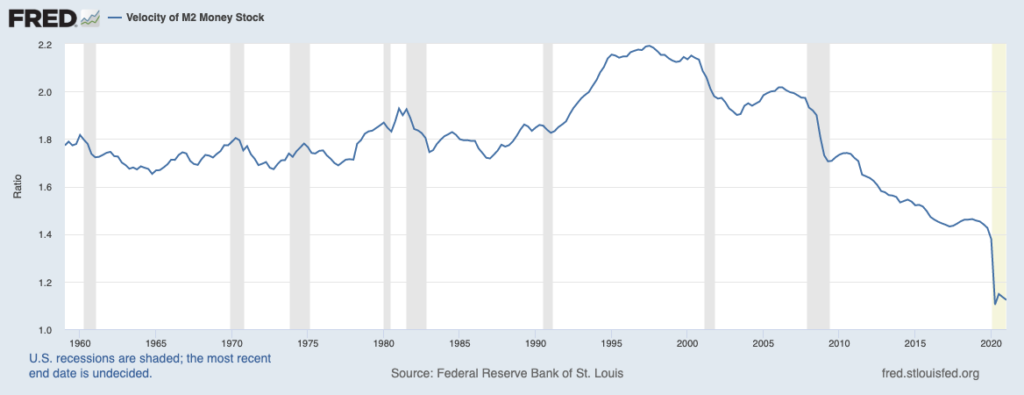

I might say we should worry, until I look at the chart below, which highlights the “velocity of money” chart. Velocity of money tells us how fast each dollar is turned over in the economy. The higher the turnover of currency, the more inflationary. Or in this case, the decline in the velocity of money would be considered disinflationary or at least offsetting any potentially inflationary effects derived from the growth in money supply.

Taken in combination, what we see is that the M2 money supply is growing above trend, while the velocity of money has shrunk by at least as much, if not more. If both of those charts were rising above trend, then I would be worried. Heck, if both were just increasing I might be worried. But if anything, their net impact makes me more concerned about an economy that will likely run out of steam prior to hitting escape velocity and igniting anything close to what would be considered “problematic inflation.”

I could bore you with economic theories, financial plumbing descriptions, and definitions of the Phillips’ curve (wait, maybe I already have?). Instead, I will say this…your growing inflation fears are overblown. FULL STOP.

Here is the FED’s Playlist

Bringing it all together, the Fed has several methods at its disposal to address inflation before it begins to overheat. Or, paraphrasing former Fed Reserve Chairman William McChesny Martin (no relation)…”The role of the Fed is to remove the punch bowl just before the party really starts to heat up.” Here are the FEDs primary moves to combat inflation…

- Raise the rate of interest they pay to banks for holding the FEDs excess reserves. This tool disincentivizes banks from lending money, which would turn those reserves (from QE operations) into loans, thereby increasing the M2 money supply. Importantly, this is a brand new tool that was created in 2008 to combat the effects of QE (we discussed this above).

- Increase the reserve requirement. This makes fewer bank assets available to create loans.

- Employ Reverse Repo transactions. This drains reserves from the banking system and raises interest rates.

- Allow the QE purchased bonds to term out or mature, thus removing the reserves that they created in the first place.

Clearly, the FED has many tools available to keep banks on a short leash, thereby controlling inflation. In my opinion, until something in the last two charts above changes materially, inflation is not a threat.

In the Word’s of David Bowie – Let’s Dance…

The Fed has plenty of tools/instruments or weapons to carry out its dual mandate. Along with this they also have every incentive to keep inflation and interest rates relatively low to keep the budget deficit manageable.

The Fed has plenty of tools/instruments or weapons to carry out its dual mandate. Along with this they also have every incentive to keep inflation and interest rates relatively low to keep the budget deficit manageable.

To this end, I feel the dance card the financial press should be publicizing to actually help investors to not fear inflation at this time is : The “Raise the Rate Roof on Reserves Shuffle”, the “Reserve Requirement Rhomba”, the “Reverse Repo Rumble”, and the “Term-out Twist!” They’re not the sexy dance moves we might see from the in-crowd at Studio 54, but they will get the job done. Let’s focus on growing our investments without being distracted by the inflation dirge of the past, by continuing to hold stocks and diversifying with high yielding alternative investments. We’ll let you know if the punch bowl gets spiked.

- Fed

- gold standard

- inflation

- interest rates

- monetary policy

- money supply

- QE

- quantitative easing

- reverse repo

- velocity of money