By Jon Porter and Andre Huaman

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts.” -Satoshi Nakomoto

What is Bitcoin, the Blockchain, and Why Care?

In 2008, a psuedo-anonymous individual, ‘Satoshi Nakamoto’, released a paper that described a digital currency he was developing called Bitcoin and the underlying technology that enabled Bitcoin, referenced as the blockchain. In 2009, Satoshi released the first Bitcoin software and began further developing it with a close handful of other scientists, engineers, and cryptologists he trusted.

In 2010, Satoshi handed over the control of Bitcoin source code (some of the keys of Bitcoin) to a set of early Bitcoin adopters/engineers, and left his role as the head developer of Bitcoin. Since then, he has yet to be identified, has not worked on or influenced the Bitcoin project, and has not transferred or spent any of his 1 million Bitcoins.

This article is the first part of a two part series in which we attempt to answer the questions: “What is blockchain (and by proxy, cryptocurrencies), should we be investing in it, and if so, how?” However, it is impossible to address whether we “should be investing in this, and if so how?”, without first understanding blockchain and cryptocurrencies.

As such, this first article is dedicated to a plain English (hopefully) explanation of those technologies. A crypto-primer, if you will. We will explain the underlying platform for all cryptocurrencies that is blockchain technology, cryptocurrencies, and why they are important.

In part two, we will engage in a detailed Q&A with a recognized blockchain expert, in an attempt to better understand the relative risks and rewards associated with Bitcoin, blockchain and cryptocurrencies, and in so doing, provide a framework for answering the questions: “Should we invest in this, what are the risks, and what should we know about this space?”

Satoshi and the small group that began working on Bitcoin were tired of governments manipulating money supply, interest rates, and currency pricing, for their own purposes.

Booting up to Speed…

Never in our collective investment management careers have we had so many people ask about the same topic, at the same time. Blockchain has clearly moved out of the realm of theoretical, and firmly into the reality of the here and now. It has serious potential implications to the way certain transactions are processed, and the systems that support them.

Why did blockchain technology suddenly become mainstream? In one sense, and on the surface, it is because of the rapid rise in value of certain cryptocurrencies, mainly Bitcoin. When something goes up 1000% in one year, it acts as its own marketing machine, which turns into a self-fulfilling prophecy. People take notice.

However, one must dig deeper into the origins of blockchain to really understand why it was invented in the first place. The advent and proliferation of blockchain technologies was in response to the types of governmental currency manipulations detailed in our November Blog.

Satoshi and the small group that began working on Bitcoin were tired of governments manipulating money supply, interest rates, and currency pricing, for their own purposes. Their response was to write code that would create an entirely new digital-only currency, Bitcoin, that was immune to manipulation, and whose pricing was set not by a centralized government. Rather, the price was set by the parties engaged in the creation and then later distribution and ultimately the marketplace trading of Bitcoin itself.

In order to understand how this came about, and how Bitcoin and other cryptocurrencies are structured, one must first understand blockchain technology.

What is a Blockchain?

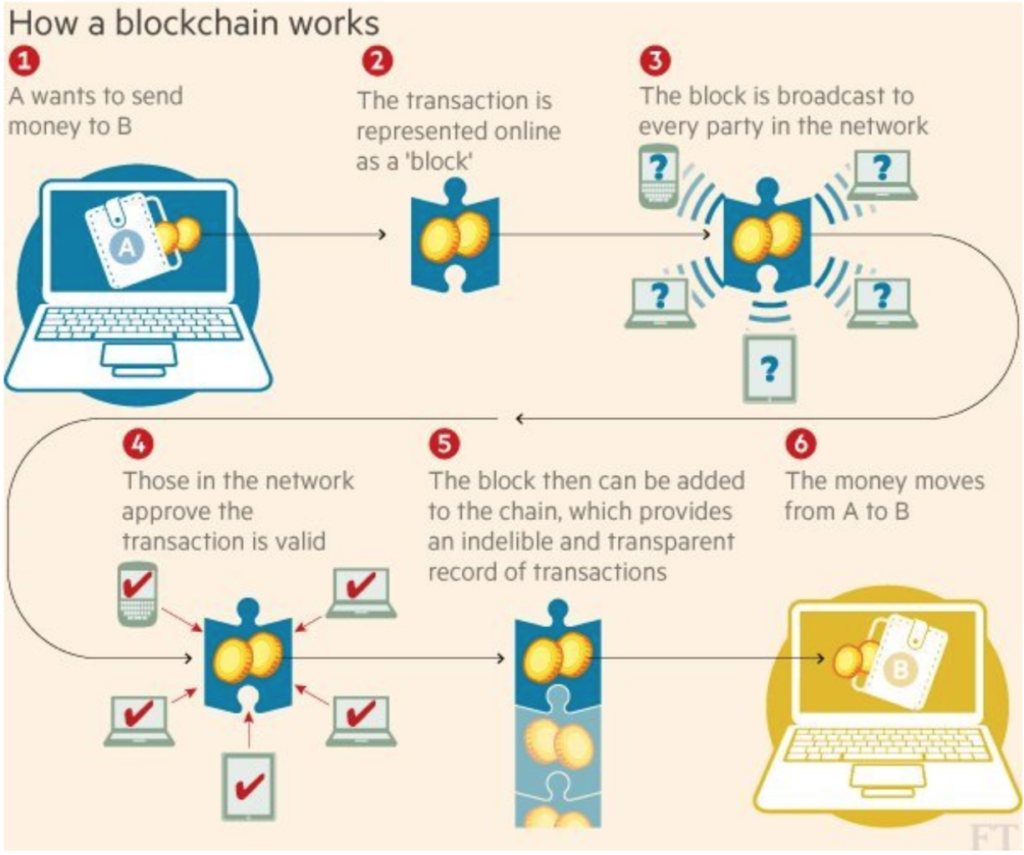

The terms “blockchain” and “cryptocurrency” are neither interchangeable nor synonymous, yet both rely heavily on one another. Blockchain is a public database and transaction processing technology.

Imagine a spreadsheet, containing information about transactions and data, that is duplicated thousands of times across a network of multiple different computers. And then imagine that this network, which tracks transactions and other forms of data, is regularly updating and validating those changes to this spreadsheet. This is blockchain.

Breaking it down into its fundamental components, a blockchain is:

- A peer-to-peer database (with copies of the database replicated across multiple computers),

- of transactions (between two or more parties)

- split into blocks (with each block containing details of the transaction such as the seller, the buyer, the price, the contract terms, and other relevant details),

- which are validated by the entire network via encryption by combining the common transaction details with the unique digital signatures of two or more parties.

Full stop. Now go back, and re-read each of those bullet points slowly and methodically, until you are comfortable with each part. This is the foundation upon which everything that follows, including cryptocurrencies, is built.

The heart of blockchain’s potential lies in the unique properties of a distributed database and how it can improve transparency, security, and efficiency.

How Does Blockchain Work?

When an individual chooses to join a blockchain network, they can download a copy of the blockchain software onto their computer. Each computer, or peer, in the network has a full copy of the blockchain, which is nearly impossible to manipulate or change. When a computer has the full copy of blockchain downloaded and installed, it becomes what is referred to as a “node.”

The heart of blockchain’s potential lies in the unique properties of a distributed database and how it can improve transparency, security, and efficiency. Historically, organizations used databases as central data repositories to support transaction processing and computation. Control of the database rested with its owner (a company’s servers, hardware, etc) who managed access and updates, limiting transparency, scalability, and the ability for outsiders to ensure records were not manipulated. A distributed database, which blockchain is, was practically impossible because of a myriad of technological limitations. But advances in software, communications, and encryption now allow for a distributed database spanning multiple organizations and individuals.

In its purest form – as used by Bitcoin to create and track units of the cryptocurrency – blockchain is a shared digital ledger of transactions recorded and verified across a network of participants in a tamper-proof chain that is visible to all. Permissioned or private variations add a layer of privileging to determine who can participate in or view a particular chain.

Blockchain’s Primary Benefits

So why is everyone so excited about this new type of decentralized database technology? Why is everyone saying this is the “next biggest thing since the Internet?” Because blockchain technology, for many types of transactions, blows traditional databases out of the water in terms of security, transparency, and efficiency.

Security

Blockchain relies on encryption to validate transactions and activity by verifying the identities of parties involved in a transaction. Further, each person on the system has a unique, encrypted, “digital signature” identifying the person; like a digital fingerprint of sorts. This ensures that a “false” transaction cannot be added to the blockchain without the consent of the parties involved.

While discussed in greater detail in the “mining” section below, in order for a transaction to be completed, a complex mathematical calculation known as a “hash” is performed each time a transaction is initiated. The transaction data, including the digital identities of the parties involved in the transaction, what is being transferred, and all previous transaction history, is verified by the complex network of computers. This process ensures that no fraud, double spending, or other erroneous actions or transactions are taking place.

And because the network is decentralized and maintained by thousands and thousands of computers, no one party has a monopoly or the ability to alter or manipulate transaction data or future transactions.

The fact that the current state of the blockchain depends on previous transactions ensures that a malicious actor cannot alter past transaction data. In effect, every time a new transaction occurs and is completed, the network of computers that maintain the blockchain are all updated to reflect the new transaction and its place in the database.

Transparency

By its very nature, blockchain is a distributed database that is maintained and synchronized among multiple nodes – for example, by multiple parties who transact with each other frequently.

In addition, transaction data must be consistent between parties in order to be added to the blockchain in the first place. This means that by design, multiple parties can access the same data (in some cases locally within their organizations).

This significantly increases the level of transparency versus conventional systems that might depend on multiple “siloed” databases behind firewalls that are not visible outside a single organization.

In practice, at any time, one can to go online and search the transaction history of any Bitcoin wallet that exists. While the person’s name may not be known, the unique ID that holds their cryptocurrency can be found publicly along with seeing on what dates that person either sent or received cryptocurrency. So, while transparent, there is also a layer of privacy.

Efficiency

Conceptually, it seems counterintuitive that maintaining multiple copies of a database with blockchain would be more efficient than a single, centralized database.

However, in most real-world practical applications, multiple parties already maintain duplicate databases containing information about the same transactions. In many cases, the data pertaining to the same transaction is in conflict – resulting in the need for costly, time-consuming reconciliation procedures.

Employing a distributed database system like blockchain across multiple organizations can substantially reduce the need for manual reconciliation, thus driving considerable savings across organizations.

In addition, in some cases, blockchain offers the potential for organizations to develop common or “mutual” capabilities that eliminate the need for duplication of the same effort among multiple organizations.

Although the world of digital currencies may seem completely novel, almost every single one of us has used a form of digital currency: credit cards. No physical money is actually ever exchanged, but ledgers of who owns and owes what are transferred digitally. The primary difference is that cryptocurrencies, in particular, Bitcoin, are not secured by people, trust, or a centralized database, but rather by the mathematical underpinnings of the blockchain which we discussed above.

…cash is exchanged for the cryptocurrency at an online exchange, and the rights to the cryptocurrency are transferred across the network to the new owner. Technically, the parties are merely exchanging the rights to a digital block on the blockchain.

Cryptocurrency? Does Webster know about this?

“Cryptocurrencies” are simply a type of digital asset that leverages blockchain technology in order to create, store, and trade the currency (each unit of a cryptocurrency is called a “coin” or “token”). The name “cryptocurrency” is derived from the fact that these types of currencies use cryptography to secure the transactions and control the creation of new coins within the same blockchain. Bitcoin is an example of a cryptocurrency.

Cryptocurrencies don’t move around as do conventional currencies or money. Rather they stay fixed on the public ledger called a “blockchain.” When it comes to blockchain, remember to think of a “ledger” as a giant Excel spreadsheet that tracks who owns what cryptocurrency and who is trading what amounts of a particular cryptocurrency at any given time. Except this particular ‘Excel spreadsheet’ is instantaneously updated, everyone who is participating in the cryptocurrency has a full and accurate copy on their computer at all times, and it is nearly impossible to hack.

As a result, people don’t “exchange” coins, they simply change ownership of a particular part of the blockchain ledger. Anyone with access to the blockchain can check ownership by checking the public ledger.

In such a transfer, cash is exchanged for the cryptocurrency at an online exchange, and the rights to the cryptocurrency are transferred across the network to the new owner. Technically, the parties are merely exchanging the rights to a digital block on the blockchain. Nothing physical is moving or is held (contrast this to gold).

The new owner can choose to hold the cryptocurrency, or theoretically convert it to cash or exchange it for other cryptocurrencies. We say theoretically because there has to be someone on the other side of that transaction willing to buy your ‘coin’ with cash or exchange it for other types of coins. More on that potential pitfall in part 2 next month.

As we’ve discussed, because of the way cryptocurrencies work, the blockchain ledger makes it difficult to commit fraud. One can’t spend someone else’s coin, because everyone knows who owns them (based on the public ledger). One can’t spend the same coin twice, because the network keeps the ledger up to date and there’s only one ledger. If the same person tried to spend the same coin twice, everyone would know because the ledger is visible across every blockchain participant and the transaction would be stopped by the system.

When launching a new cryptocurrency, one of the critical decisions is to choose the “mining” method.

How do Cryptocurrencies Store Value?

There are now over 2000 cryptocurrencies on the market, such as Ethereum, Monero, and ZCash, with more coming every day. So it is imperative to pay attention to how these cryptocurrencies intend to retain their value, if they are to act as surrogates for money.

Recall from your high school economics classes that “money” must possess six key traits:

- A medium of exchange

- Portable

- Durable

- Divisible

- Fungible, and drumroll….

- A store of value

From what we have reviewed above, it is readily apparent that blockchain technology enables cryptocurrencies to satisfy the first 5 requirements of money. It is the last requirement, that it be a “store of value” to which we now turn our attention.

Remember that just like any currency, cryptocurrencies are only as valuable as those that are trading them believe them to be. Merchants accept dollars in exchange for goods because they have faith that the paper money, or the credit card ledger that corresponds to that paper money, is a store of value, and can be exchanged for other things of value.

It is therefore critical to understand exactly how a blockchain system creates additional coins, incentivizes participants to maintain the system, and is a mechanism with the potential to maintain and increase value.

Mining Cryptocurrencies

When launching a new cryptocurrency, one of the critical decisions is to choose the “mining” method. Every cryptocurrency is forced to choose between two methods; ‘Proof of Work’ or ‘Proof of Stake’. Coins can only use one and the method they choose depends on a variety of factors including on which blockchain they are building, the goals and objectives of the project, and the goals for their community.

Proof of Work (“PoW”)

One of the core events that must continuously take place in order to maintain the cryptocurrency ecosystem and blockchain is “mining.”

Approximately every 10 minutes, a number of Bitcoin transactions are grouped together into what is called a “block.” These transactions might be a son sending Bitcoin to his grandmother or a financial institution buying cryptocurrency for the first time. Regardless, these crypto transactions are grouped together into a consolidated block.

These blocks, each containing multiple pending transactions, are turned into a mathematical problem/puzzle. In order for these transactions to be approved, verified, and completed within the blockchain, those math problems must be correctly solved.

Insert miners. Miners, which are effectively very powerful computers, compete to be the first to solve the math problem. Once the first miner solves the problem, it announces to the network that it has been solved. Other miners then verify the equation is correctly answered.

Once verified for accuracy, the transactions represented in the block are allowed to be completed and added to the public ledger on the blockchain. The grandmother receives her Bitcoin and the client receives his or her cryptocurrency. The miner who found the solution and answered the equation for the block is rewarded by being given the cryptocurrency they are mining for.

So, miners are rewarded in cryptocurrency. This mining process, which is happening at all times, is the function that not only upholds the integrity of the blockchain, but also distributes newly minted cryptocurrency into the ecosystem at a predetermined rate.

The cryptocurrency mining reward, and therefore the value of the associated coins, is required as it acts as an incentive for the miners to utilize their computing power, electricity, and time to mine. If Bitcoin was worth $0, why would people volunteer and/or be in the business of mining? Why would they have their supercomputers run 24/7, solving math problems, when being rewarded nothing? Without value in the underlying coin, miners would have no reason to utilize their resources to support the system (hence, why Bitcoin and other true cryptocurrencies need value).

The above is how mining works for Bitcoin, the most reputable and oldest standing cryptocurrency. As of late, a new style of mining, called “proof of stake” has entered the field as a positive alternative to proof of work.

Even as traditional IPOs have slowed to a historical trickle, there were almost 300 Initial Coin Offerings (ICOs) in 2017, with a total of over $3.7B raised.

Proof of Stake (“PoS”)

Proof of stake is another way a blockchain can validate and approve blockchain transactions. Unlike PoW, where the winner of the block reward is determined based on computing power and the ability to solve mathematical problems, PoS currencies approve transactions by utilizing resources from current owners of the coin, who publicly “stake” their coins in order to help validate the system.

In PoS, owners of the coins are semi-randomly selected to create or “forge” blocks, validate them, and approve their inclusion in the blockchain. The more coins you have, the higher chance you have of being chosen by the system to forge the block. This process is less energy intensive than PoW and rewards current users for owning a portion of the coins.

PoS helps avoid several downsides of PoW, including:

- Reduces need for expensive hardware

- Reduces energy spent on powering the hardware

- Faster and more efficient validations

- More loyalty amongst coins

Some potential PoS downsides include:

- Reduced security

- Small group of owners taking over system

The industry is still debating which type of mining system is best. However, we have examples of both in the cryptocurrency marketplace today and expect the discussion to continue. When a new cryptocurrency is developed, it is required to choose either PoS or PoW. That decision determines a major part of how the new cryptocurrency will operate.

How long before traditional credit cards and checks, built on outdated 1970’s era technology and security, are obliterated by blockchain the same way email replaced snail mail? The answer: not as long as you might think…

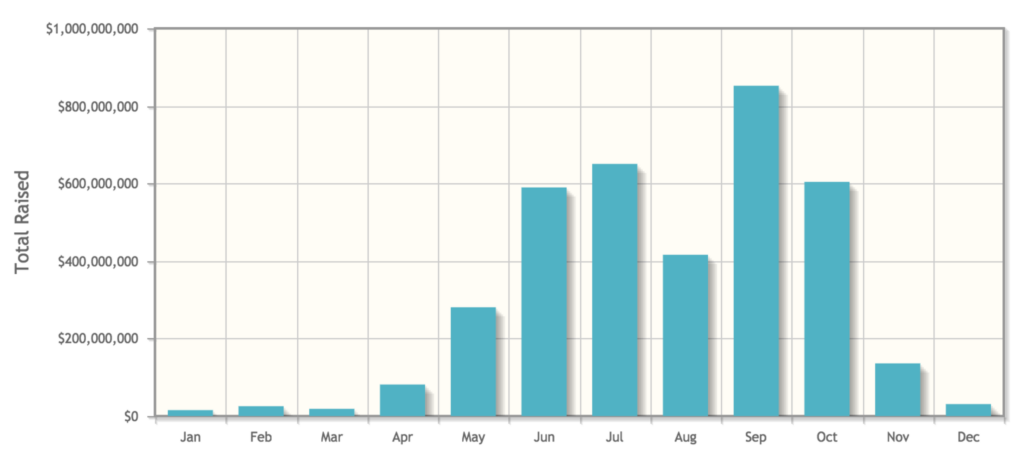

Is ICO the new IPO?

Initial Coin Offerings (ICO) have become a popular way to fund both cryptocurrency projects and the companies that promulgate them. An ICO is an event whereby a new blockchain/cryptocurrency project sells part of its cryptocurrency tokens to early adopters and investors in exchange for money.

Even as traditional IPOs have slowed to a historical trickle, there were almost 300 ICOs in 2017, with a total of over $3.7B raised. There are more planned for 2018 with the estimated total amount to be raised topping $5B.

Essentially, ICOs are a fundraising mechanism. The ICO usually takes place before the project is completed, and helps fund the expenses undertaken by the founding team until launch. Similar to IPOs (hence the name), ICOs are used to sell a “stake” and raise money. Both have investors who see the potential of a particular project or coin and risk their capital for a potential reward.

While we will discuss the potential hazards of ICOs, and there are many, in part two next month, we would be remiss not to mention that many recent ICOs have resulted in scams, fraud, and misleading projects.

When will Blockchain Technology Really be Adopted?

Consider this: credit cards typically take between 2-3% in transaction fees for every purchase made. Blockchain and cryptocurrencies can take far less due to the efficiency of digital ledger technology.

Similarly, when someone writes a physical check, you take it to the bank, physically deposit it, and wait for the check to clear based on your bank’s verification. That process is slow, usually taking a few days for a check to “clear” and funds to hit your account, or the check might bounce.

How long before traditional credit cards and checks, built on outdated 1970’s era technology and security, are obliterated by blockchain the same way email replaced snail mail? The answer: not as long as you might think…

Although blockchain is still nascent from an adoption standpoint, the horse appears to have left the stable. Most of the experts expect to see early-stage technical prototypes within the next two years, with limited market adoption in 2-5 years, and broader acceptance in 5-10 years.

However, a variety of industries could begin to implement blockchain-based identity and reputation management systems in relatively short order. They extend from identity theft, real estate contracts, insurance, and more. In capital markets, expect to see a series of early prototypes over the next two years on a limited scale and with limited numbers of participants.

Broader market acceptance is likely to take as much as 10 years given the regulatory oversight required and a large number of market participants in large-scale markets such as cash equities in the US.

Summing Up

Blockchain, as a technology, is eventually going to fundamentally change the way many types of complex transactions are processed. And, in the more immediate sense, blockchain technology has enabled the creation of a myriad of cryptocurrencies which are challenging the way we think about money and currencies across the board.

This primer to next month’s deeper dive is designed to help understand the key terms and concepts that form the framework for blockchain and cryptocurrencies. Next month we will take this newfound knowledge and, through Q&A with a cryptocurrency expert, attempt to answer the questions “should we invest in this, and if so, how?”

Until then!