THE WIZARD OF “OZ”: MITIGATING CAPITAL GAINS TAXES THRU OPPORTUNITY ZONES

Everyone remembers the beginning of The Wizard of Oz, when we watched Dorothy’s home destroyed by a massive tornado. While we didn’t see the full aftermath of the devastation (after all it was a children’s movie), it was easy to surmise that Dorothy’s town was going to need some serious capital.

We then followed Dorothy as she arrived in the magical Land of Oz, and began her journey down the famous Yellow Brick Road, which eventually led her to the beautiful and impressive Emerald City. In so doing, we went from a small town in desperate need of money to rebuild, down the path of prosperity, and ultimately arrived at a fully-developed, thriving metropolis.

In this edition of Cutting Through the Noise, we examine and discuss a parallel OZ: Opportunity Zone (“OZ”) investing. We show you a path down the Yellow Brick Road that leads to dramatically reduced capital gains tax burdens, and provides a full decade of tax-free appreciation in a new real estate-based investment that ultimately supports underserved communities. From Kansas to the Emerald City, if you will.

In our opinion, this is hands down one of, if not the most, powerful pieces of tax legislation passed in the last two decades; for once the government gets to play the part of the Good Witch! But, the clock is ticking… OZ investments, as the law is currently written, go away at the end of the 2019 calendar year.

In our opinion, this is hands down one of, if not the most, powerful pieces of tax legislation passed in the last two decades.

This means, entrepreneurs and corporate executives with highly-appreciated, concentrated positions, need to quickly familiarize themselves with Opportunity Zone investments, and how to leverage them to diversify their portfolio and reduce capital gains taxes, if they hope to take advantage of it before year end.

So, click your heels together three times, and let’s dive in! We’re definitely not in Kansas anymore, Toto…

The Good Witch: The TCJA and the Creation of Opportunity Zones

Many of our clients hesitate to diversify out of a concentrated equity position because of substantial embedded gains, and the taxes they would have to pay upon sale. Still others have sold or are planning on selling their companies, and are equally struggling with how to shield the gains from taxes.

Until recently, the most advantageous tax treatment you could hope for was either 1) long term capital gains, or, if you met all the criteria, 2) the $10M capital gains tax exemption available under the Qualified Small Business Stock Exemption (“QSBS”).

Unfortunately, long term capital gains, when factoring in both state and federal taxes, can still add up to over 30% for investors in the highest income tax brackets.

Further, QSBS, while providing a full capital gain tax exemption for some investors, has multiple, often difficult to meet criteria, only applies to positions acquired when businesses were “small”, can be rendered less effective by AMT, and caps out at $10M per investor.

Unfortunately, long term capital gains, when factoring in both state and federal taxes, can still add up to over 30% for investors in the highest income tax brackets.

The reality is, both long term capital gains and QSBS tax treatment have their limitations. However, with the passing of the Tax Cuts and Jobs Act (“TCJA”) in 2018, Congress created a third, very powerful way to mitigate capital gains taxes: Qualified Opportunity Zones (“OZ’s”).

OZ’s are economically depressed geographic areas throughout the US that the TCJA is designed to help gentrify, by providing taxpayers incentives to invest money into these designated cities. Think rebuilding Kansas, post-tornado strike.

The TCJA accomplishes this by allowing taxpayers who have realized capital gains from the sale of a capital asset (i.e the sale of stock or a business), to reinvest those gains, within 180 days of sale, into Qualified Opportunity Funds (“QOF’s”).

QOF’s are investment vehicles that deploy investors’ capital into OZ’s, typically into real estate projects located within the OZ.

QOF’s are investment vehicles that deploy investors’ capital into OZ’s, typically into real estate projects located within the OZ. The QOF must develop or “substantially improve” acquisitions of land and/or assets on a 1:1 basis within 30 months of acquisition, and have 90% of their capital deployed into OZ’s.

Assuming the above criteria are observed, a QOF allows an investor to:

- Defer payment of the original capital gains taxes triggered by the sale of the appreciated asset for up to 7 years, and

- Receive a 15% reduction in the original capital gains taxes due, and

- Withdraw all the capital gains attributable to the QOF investment, tax-free, after 10 years

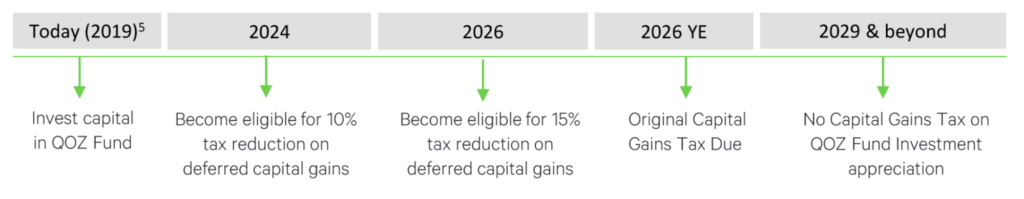

Our friends at Bridge Investment Group, a seasoned real estate investment management team, put together the following, easy-to-understand chart that illustrates the timeline and associated benefits inherent in OZ investing:

Lion-Size Courage: The Power of Compounding Tax-Free Returns

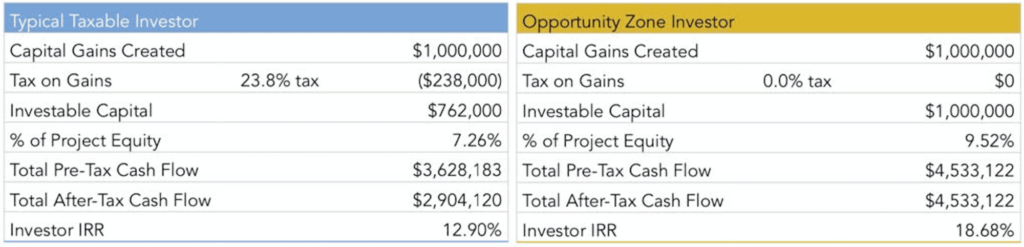

Consider the below comparison, which our friends at Pinnacle Partners put together. Assuming the same rate of return both in the QOF and in a fully taxable environment, $1M invested in an OZ produces $4,533,122 net, and only $2,904,120 net in a taxable environment, approximately a 58% difference over 10 years.

Factoring in the tax savings on the original gain, as well as the compound tax-free returns of the QOF, the non-QOF investment would have to return a whopping net 18.68%, in order to equal a 12.9% return in a QOF.

Even if you compared very similar real estate investments, and factored in favorable tax treatment for some REIT’s, it is extremely difficult to generate 18%+ returns year over year, without taking on substantially more risk.

We’re Not in Kansas Anymore: Case Studies

Let’s take a look at a few real world examples and see how an OZ investment would mitigate taxes in each situation.

Entrepreneur Exits Company

Sarah is a successful entrepreneur, and sells her company, realizing a capital gain of $10M. She then subsequently reinvests the entire $10M gain in a QOF within 180 days of sale, and prior to the end of 2019.

- Assuming she made an election to treat the QOF investment as a deferral, the $10M of realized gain will be excluded from her gross income in tax year 2019 (i.e. she won’t pay any taxes as a result of the sale).

- If she leaves the invested amount in the QOF for 5 years, 10% of her original $10M gain is eliminated. At a 25% blended federal and state long term capital gains tax rate, this would result in a tax savings of $250K.

- If she leaves the invested amount in the QOF for 7 years, an additional 5% of the original gain is eliminated (15% total). Again, at a 25% blended long term capital gains tax rate, this would result in a tax savings of $375K.

- If the QOF returns are 7.2% compounding annually, her initial $10M investment in the QOF will increase in value to $20M by the end of 10 years.

- After 10 years, she may exit the QOF and pay zero taxes on the $10M of gain attributable to the QOF over that 10 year period. At the same 25% long term capital gain tax rate, this would result in a tax savings of $2.5M.

Executive Sells Shares

Jeff is an executive at Apple and decides to sell some share he received as a part of his equity compensation package, generating a long term capital gain of $1M. He then subsequently reinvests the entire $1M gain in a QOF within 180 days of sale and prior to the end of 2019. The $1M investment in the QOF then appreciates to $2M by year 10.

Fighting Off Flying Monkeys: Key OZ Considerations

Prior to investing in a QOF, investors must be well aware of a few critical considerations of a QOF investment.

- 180 Days From Sale: The realized gains on any sale must be reinvested into a QOF within 180 days of the date of sale of the asset.

- 2019 Deadline: In order to receive the full measure of QOF benefits, the latest date that gains on the sale of assets can be invested into a QOF is December 31, 2019. Past that date, investors will begin to lose out on many of the QOF tax benefits.

- 2026 Taxes Due: The deferral of the gains on the funds used in the initial investment isn’t perpetual. Gains reinvested into a QOF will become taxable (except for any tax reductions received after years 5 and 7) at the end of 2026 (or when the QOF is sold, if sooner). This means that at the end of year 7, the investor must be prepared to pay the reduced original capital gain tax bill.

- Paying the Piper: If the investor does not have sufficient liquid capital to pay the tax bill due after year 7, they would have to withdraw enough capital from the QOF to pay the reduced capital gains taxes, thus reducing the overall amount that can be left in the QOF for the 10 years necessary to trigger tax free treatment of the gains attributable to the QOF investment.

Invest Like the Scarecrow (Intelligently) and Do Your Homework

It’s easy to see just how powerful and universally applicable OZ investing can be. However, it is not without risk.

Despite the obvious and powerful tax benefits, investors should exercise caution and work with an advisor to perform proper due diligence, as they would for any other investment. Bad investments with positive tax attributes are, at the end of the day, still bad investments.

A qualified wealth manager will diligence the fund management team’s qualifications, tenure, and track record. For the QOF’s themselves, they will also understand the fund expenses, nature and quality of the underlying assets (which are largely illiquid), and the potential for growth and/or income from the specific real estate investments.

Despite the obvious and powerful tax benefits, investors should exercise caution and work with an advisor to perform proper due diligence, as they would for any other investment.

However, as mentioned, most QOF’s (at least thus far) are investing into physical real estate located within the OZ.

These investments could be new development projects, or they could be building or property acquisitions with existing long term tenants (e.g. senior assisted living facilities, apartment buildings, etc…), that are then substantially renovated.

Either way, QOF’s are collateralized by physical real estate and buildings, making them a comparatively safer investment vs. stocks which have the potential to go to zero, and are otherwise generally much more volatile. It’s like the difference between owning the Emerald City itself, or Emerald City, Inc.

There’s No Place Like Home

Coupled with the Qualified Small Business Stock exemption, Opportunity Zone investing now provides entrepreneurs and investors with concentrated equity positions with a secondary method of shielding capital gains from taxes. Ruby slippers indeed.

However, like Dorothy, our time in OZ is limited. At least as currently written, the TCJA requires these investments to be made before the end of the 2019 calendar year. So, time is of the essence.

If you are considering, or have already sold, a highly appreciated asset, and wish to speak with us about whether and how an Opportunity Zone investment might be used to help defer and reduce your tax liability, while providing for 10 years of future tax-free asset growth, please don’t hesitate to contact us. This is one instance where what you don’t know can hurt you, and no one likes to get caught in the tax tornado…