Think Alternative(ly)… Invest Different

By: Will Martin

Senior Managing Director and Investment Strategist

With both stock and bond markets priced for perfection, it is time to look for asset classes that can provide true diversification to lower risk and increase returns.

Introduction

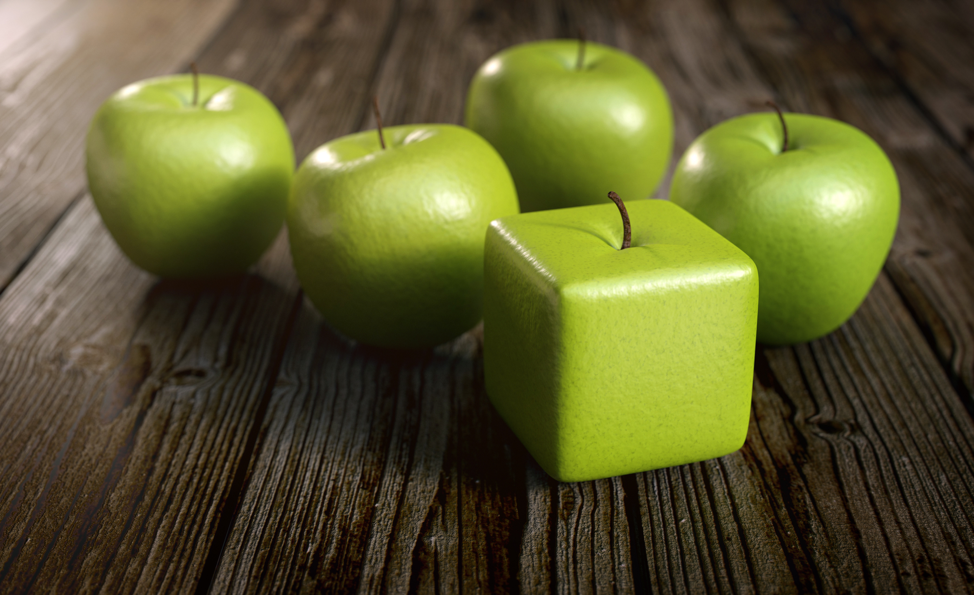

Apple, Inc. taught us the power and promise available through embracing change, if we only learn to ‘Think Different’. We believe that has never been more appropriate and applicable than right now for the financial markets. In an homage to that timeless Apple precept, we encourage investors to look beyond the typical herd mentality for answers and find “alternative” sources of excess returns. With the bond market offering record low yields and the stock market trading at record high earnings multiple valuations, we try to answer the question… what’s an individual investor to do?

We’ve all heard it our entire investing lives: diversification is the key to stable, long-term investment returns. OK, great, but diversification into what exactly? It’s entirely possible to diversify into a terrible investment and in so doing, do yourself a disservice. Logically, diversification into just “different” investments, in and of itself, is not going to help investment returns, particularly in the event of a substantial market correction.

Historically, for many investors, diversification has meant spreading assets across different segments of the stock market, with a portion of the allocation going to smaller more nimble growth-oriented companies, some to larger more established value-oriented companies, and then splitting that up across both domestic and international exposure. The resulting pie chart shows a wonderfully diverse array of colored pie wedges, creating the illusion that we have accomplished our diversification objectives (at least graphically).

The only way to achieve this “true diversification” is through an asset class broadly referred to as “alternative investments.”

However, when markets experience severe declines, the returns of these various sectors tend to homogenize and drop at the same rate. This is what we refer to as “correlation.” During the Great Recession, even if you had all of your fixed income allocation in US Treasuries you still experienced a drawdown of -20% or more. That number was closer to -40-50% if you were 100% in stocks and bonds that did not contain Treasuries… no matter if you were in US or International, investment grade corporates, or high yield bonds.

So, when we think about true diversification, and the benefits we are supposed to realize from that concept, we must find investments that are not correlated to the larger stock and bond markets, and are capable of generating positive returns regardless of any form of precipitous correction, market decline or increase in interest rates.

The only way to achieve this “true diversification” is through an asset class broadly referred to as “alternative investments.” By using alternative investments, it is possible to design an “all-weather” investment portfolio where each individual component of the allocation is making money in a way which is both divorced from the broader stock and bond markets, and at the same time different from the other investments within the portfolio.

In this edition of Cutting Through the Noise, we investigate how to use alternative investments as a key component to portfolio construction to achieve stable non-correlated, long-term returns, and why it is particularly important to do so now given where we are in the current market cycle.

Low Expected Returns for Stocks and Bonds and the Need for Diversification

In order to understand the importance of incorporating alternatives into your portfolio, we must first understand the current challenges of the two traditional primary asset classes: stocks and bonds. As you will see below, neither are poised for outsized gains, and instead both are set to experience significant headwinds.

Bond Market Headwinds

In the fixed income world, we earn the interest income from the bonds we hold, plus or minus any increase or decrease in the underlying value of the bond holdings. The biggest driver of increases or decreases of bond prices are interest rates, namely, what is the present interest rate vs the rates when the bonds we hold were issued.

As interest rates rise, the price of a bond portfolio tends to depreciate, and vice versa. This is because in a rising interest rate environment, new bonds are being issued which pay higher coupon rates than those that are held in the current portfolio. Thus, if those bonds were to be liquidated in that environment, they would need to be discounted to account for the lower coupon payments.

So, where are we in this cycle? Gradually lower and lower interest rates due to global Central Bank bond buying programs (“Quantitative Easing”) has driven interest rates to levels previously not seen. From this level (see chart below),

there is more risk than return available in the bond market.

Based on the chart above, we believe that its more likely interest rates will rise from where they are now… versus fall. If this is in fact accurate, the best case is for bond investors to earn the income associated with the bond coupon and hold those bonds to maturity to eliminate interest rate risk and resulting pricing fluctuations. This puts returns anywhere between 2-5%, depending on how much credit risk an investor is willing to accept.

Stock Market Headwinds

As a result of these artificially suppressed interest rates, investors have sought higher returns elsewhere and have correspondingly pushed stock prices to near historical high valuation multiples – particularly when considering the low level of economic growth in the underlying economy.

In order to understand where the headwinds exist in the stock market, we need to start with the general understanding that the more an investor pays for earnings, the lower their expected return. We have a nice chart that illustrates that point below.

Both the bond and stock markets are much more likely to decline than provide historical levels of return going forward.

Time to get outside of the box…

The market is currently trading at earnings multiples that are higher than any other time in our history, except for a few months in 2000. As such, we believe P/E multiples are unlikely to expand much further and are instead much more likely to contract.

This, coupled with muted GDP (around 2%), means that earnings growth is also likely to be muted which creates overwhelming risks to the downside for the stock market. Historically, the 10 years after the stock market trades at these levels, the result is a paltry 1% annual growth (see our CAPE blog for more in depth analysis).

Key Takeaway

Both the bond and stock markets are much more likely to decline than provide historical levels of return going forward. Interest rates are more likely to rise than fall dramatically hurting bonds, and earnings multiples are more likely to revert to the mean and compress hurting stocks.

As a result, we believe traditional portfolios that have relied solely on these two asset classes for diversification and returns are, at best, going to suffer mediocre returns for the foreseeable future, and at worst (particularly in the case of the stock market) suffer severe declines in asset values.

Time to get outside of the box…

What are Alternative Investments and What Do They Do?

The intent of considering alternative investments is to maximize the odds of increasing our total investment return profile, while reducing the risks that are stacked against us if we invest only in the public stock and bond markets.

The chart below illustrates some of the high level key differences between alternative and traditional investments:

The alternative investment category opens up a broad universe of options that are often times overlooked, which if properly deployed can create correspondingly superior risk/return opportunities.

We are all very familiar with the “Traditional” row on the top of the chart – buy stocks and bonds and hope they go UP…that is what is meant by “Market Direction Sensitive” in the last column in the top row above.

In the “Alternatives” row on the lower part of the chart we see options beyond just stocks and bonds which, very generally, include all asset classes other than long stocks, bonds, and cash. Specifically, Alternatives include funds that trade long/short equity, real estate, private equity, life settlements, venture capital, commodities, merger arbitrage, specialized debt, and much, much more.

The alternative investment category opens up a broad universe of options that are often times overlooked, which if properly deployed can create correspondingly superior risk/return opportunities.

The triangle chart below provides a conceptual framework that illustrates the potential benefits of combining various alternative investments. Specifically, alternative investment portfolios should include an intelligent combination of fund strategies that generate outsized uncorrelated returns, deliver inflation protection, and provide hedged downside protection thru “true diversification.”

…many hear the term “hedge fund” and pre-judge in the negative, either because of historical underperformance or because they have heard hedge funds are all “risky.”

Impact of Alternatives on Portfolio Returns

We wouldn’t be looking at this important asset class if it didn’t deliver demonstrable benefits. However, we must start with a caveat: most alternatives are packaged as “hedge funds” and most hedge funds have lagged the broader stock market recently. As such, many hear the term “hedge fund” and pre-judge in the negative, either because of historical underperformance or because they have heard hedge funds are all “risky.”

“… alternatives have shown the ability to both lower risk AND increase return.”

To that we have three comments:

- Returns are time period dependent. As such, many hedge funds did their jobs well and looked dominant vs index funds and ETFs leading up to and through the financial crisis. They “hedged” against negative returns. That’s what they do. Now that the market has run to historically high valuations (see above), would you rather stay almost entirely in long only stocks and bonds or consider diversifying to hedge some of the downside?

- There are many types of hedge funds, ranging from “conservative” to “aggressive” and everything in between, and many of them do not simply “hedge” stock or bond market risk. In fact, some of them are completely off the grid, don’t have anything to do with stocks or bonds, and can perform well regardless of what the broader stock or bond markets do.

- Keep an open mind as we avoid driving through the rearview mirror. Investing is not easy and the truest long term successful strategy is to be contrarian. Many alternatives and hedge strategies are built to capitalize on this phenomenon.

We have two very important graphs to examine below. The key take-away is that alternatives have shown the ability to both lower risk and increase return. This is despite following a record bull market run facilitated by the world’s central bankers. History suggests that the risk-return benefits of alternatives will be even higher in the intermediate future.

The first graph shows the risk and return for a typical “balanced” 60% stock and 40% bond portfolio. The stock portion is invested 2/3 domestically and 1/3 internationally. The return of that balanced portfolio has been 7.94% with an annualized volatility of 8.81%. This portfolio is said to have a simplified Sharpe ratio (return/volatility) of .90.

This simplified Sharpe ratio is an efficiency evaluation metric to indicate how much return your portfolio gets per unit of risk. The benefit of lower volatility is that it will typically help investors from selling at the wrong time. It is always important to keep that number as low as possible.

The next graph below shows the benefit of allocating 50% of the portfolio to Alternatives, while keeping the remaining 50% in the 60/40 stock bond mix cited above. The return increases to 9.33%, while risk declines to 7.28. This configuration delivers a 1.28 Sharpe ratio, or a 42.4% increase in efficiency. Greater returns, less risk. Check!

“… investors often end up taking more risk by going into riskier market segments like high yield bonds or emerging market equities at just the wrong time. At market peaks, these segments actually add risk rather than reduce risk. We call this Di-worse-ification.”

These graphs clearly illustrate the benefit of adding alternatives into a portfolio otherwise comprised entirely of stocks and bonds. The alternative investments into which we are currently deploying capital should have an even more dramatic positive effect, as they have higher expected returns with lower downside risk than the examples used in the above graphs.

Summary: Utilize Alternative Investments to Provide True Portfolio Diversification, NOT Di-worse-ification!

As we began by postulating, most investors seek to diversify their return patterns by going into more and different public market sectors. While this can be helpful, investors often end up taking more risk by going into riskier market segments like high yield bonds or emerging market equities at just the wrong time.

At market peaks, these segments actually add risk rather than reduce risk. We call this phenomenon, “Di-worse-ification”: the act of unknowingly constructing a highly correlated portfolio. The dangers of diworseification are highest at low levels of interest rates, tight credit spreads and elevated earnings multiples. Strike 1, 2 and 3.

We want to highlight the benefits of including completely different asset classes with different return drivers, such as some of the broad categories mentioned in the segments above. The potential benefits and opportunities of including alternative assets have never been greater.

With the stock and bond markets both priced for near perfection, the greatest risk is that stock and bond markets continue to trade together. This means higher interest rates will bring lower bond prices. Higher rates will also bring commensurately lower earnings multiples and lower stock prices. In that event, diversification into traditional asset classes will not mitigate risk or stem investment losses.

That said, we see plenty of opportunity to reduce an investor’s risk profile, while increasing potential returns. Investors need to expand their selection universe to include new ‘alternatives’. This month we introduced the benefits of including alternatives in a well-diversified portfolio. Next month we will dig deeper into specific alternative investment opportunities.