MMMMMM… Trade Pie

Escalating Trade Tariffs and their Potential Impact on the Global Economic Pie

Meeting Nelson Mandela in June 1995, during the Rugby World Cup in Johannesburg (aka Invictus), was one of the most memorable events of my life.

As an institutional mutual fund manager, I was on the other side of South Africa’s very first currency/asset swap. This transaction curried just enough favor to get a brief, serendipitous one-on-one meeting with President Nelson Mandela.

I will never forget when Mr. Mandela said “The ANC (African National Congress) is not trying to get a bigger piece of the economic pie, but rather to grow the pie for everyone”. His wisdom was comforting in regards to the future of South Africa and still inspires me to this day.

At that time, apartheid had just ended and there were a number of domestic and international investors concerned about the direction of the newly elected, non-white government. Mandela knew that he had little leverage and needed to unite his country in order to calm investor fears and attract foreign capital. He was successful.

“Increased tariffs drove down global trade 65% and played a role in deepening the depression of the 1930’s.”

Fast forward to today and we see the Trump administration taking a different approach, imposing tariffs as leverage to renegotiate many, if not all, US trade deals and agreements. This administration’s tactics seem designed to grab a larger slice of the pie for the US, despite the very real risks that such a strategy may actually shrink the size of the pie for everyone.

Trade Recipe – History of Free Trade

Global trade is large and important to the world economy, but it is also complex and has its pluses and minuses. Global trade does not lend itself to “one off” transactional deals, where one side tries to get the better of the other. The idea is that both sides can win, when the ingredients are measured and oven conditions are right for the pie to grow.

The conditions for free trade were put in place through US leadership following WWII. In 1947, GATT (General Agreement on Tariffs and Trade: 1948-1994) was enacted to create a more fair and conducive landscape for global trade. GATT was seen as an important step toward global free trade following the Great Depression and WWII.

“Free trade is not a conservative vs. liberal argument.”

Global free trade has not always been so “free”. The Smoot-Hawley Act (1930) imposed high tariffs and protectionist measures following the stock market crash in 1929. These increased tariffs drove down global trade 65% and played a role in deepening the depression of the 1930’s. The 1947 GATT agreement was initially signed in Geneva by 23 countries to reverse the damage done by the Smoot-Hawley Act. The member countries grew to 123 during the Uruguay Round Agreement in 1994.

The Uruguay Round ultimately established the WTO (World Trade Organization), which replaced GATT in 1995. These two consecutive organizations have been successful in decreasing average tariffs from 22% in 1947 to 5% after 1995.

The WTO now helps to facilitate international trade, and sets the rules for trade and arbitrate infractions. As such, there is no single agreement or organization that now impacts global trade as much as the WTO.

As we will see below, the US has historically benefitted from most trade deals even though it has occasionally subsidized others. Regardless, it is clear that the US is the strongest economy in the world with trade being a positive contributor to our sustained growth and low inflation.

Is This Pie GOP Cherry Red or Democratic Blueberry?

Importantly, free trade is not a conservative vs. liberal argument. Republicans have long been supporters of free trade, while the Dems also have their own fingerprints all over free trade agreements from NAFTA (North American Free Trade) to TPP (Trans Pacific Partnership) to the WTO (World Trade Organization).

The Trump administration’s policies seem to be taking trade back in the direction of “Economic Nationalism”, which we have not seen for the past 70+ years, since free trade became the dominant trade ideology.

In fairness, President Trump’s supporters claim that he is escalating the tariff discussion in an attempt to level the playing field for US producers. His detractors point out there is already a process in place to make his case through the World Trade Organization (WTO).

Another argument in favor of Trump’s approach is based on national security reasons and the need to have a vibrant manufacturing economy and middle class. His opponents say these claims are largely political and point to technological innovation as having a greater impact on jobs and wages than outsourcing to cheaper labor markets.

“The relative importance of trade between the US and the rest of the world is likely the argument upon which the Trump administration bases it’s sentiment that the US has leverage to re-negotiate our trade deals.”

The Importance Of Global Trade In Three Pictures – Sorry, No Pie Charts…

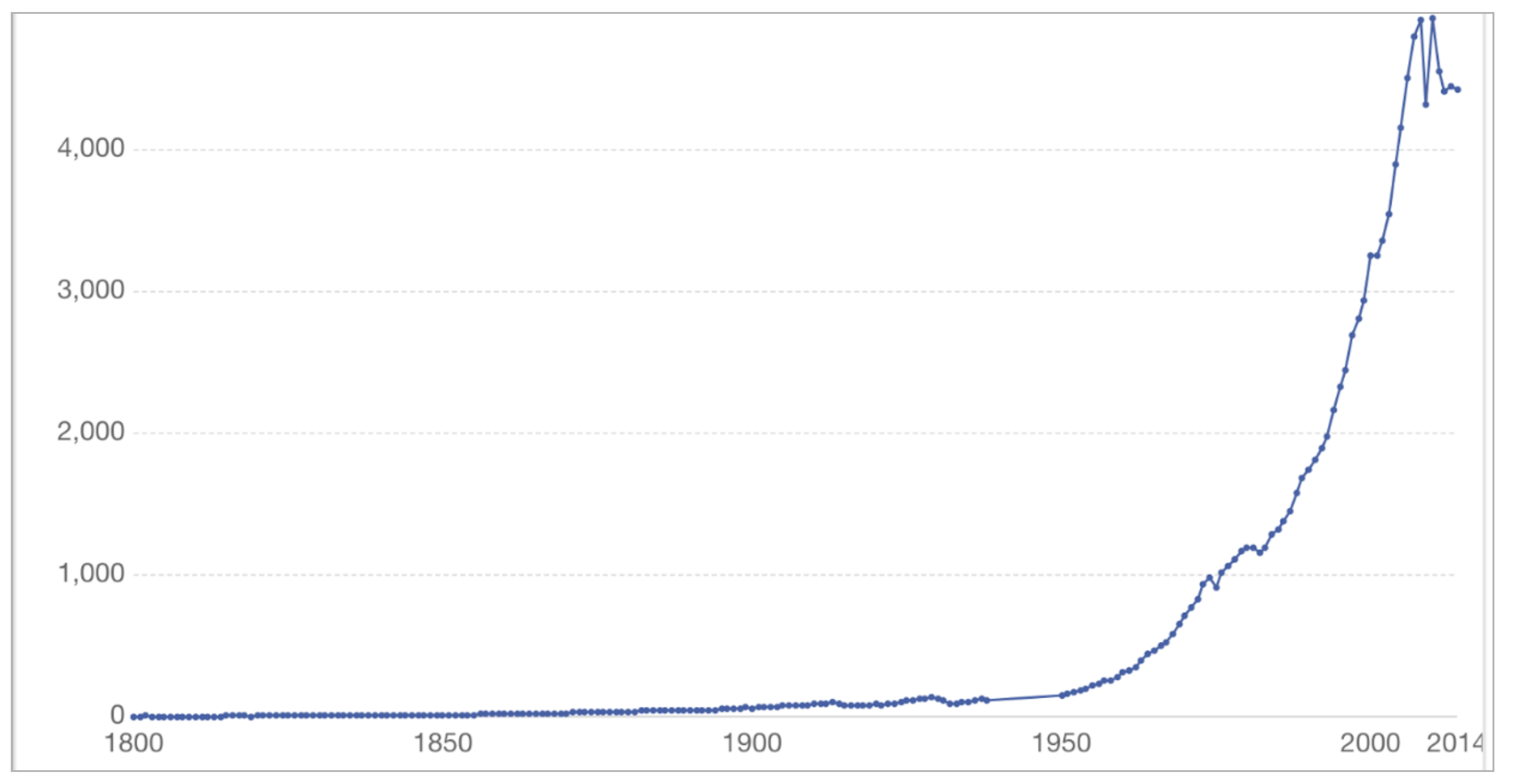

Free trade has been a positive factor in growing Global GDP and keeping inflation low. After stagnant trade values for over 150 years, global trade has been on a steady incline since the end of WWII until the Great Financial Crisis (GFC) of 2008 (see chart 1). In fact, global trade has grown at almost twice the rate of domestic growth…while helping to keep inflation low. This inflation link demonstrates how imported goods have seen price declines that have helped to contain the inflation rate, while domestic services have generally been lifting inflation.

Chart 1 – The Value of Global Exports

Source: Federico & Tena-Junguito (2016)

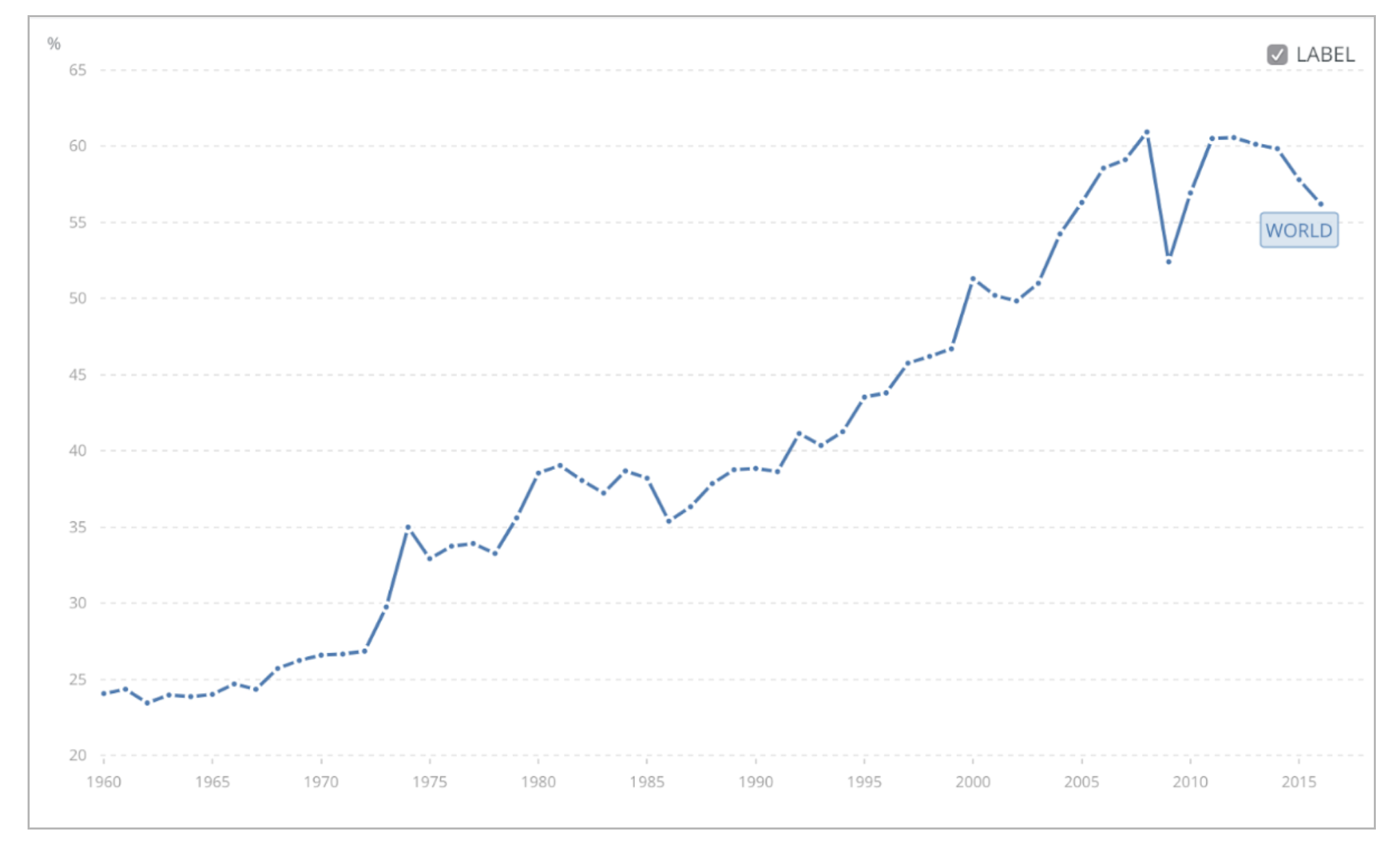

Chart 2 below shows how important trade has become for the global economy. Unfortunately, trade now appears poised to turn down.

Global trade represents ~60% of global GDP, which is approximately twice as important as trade is for the US, which derives ~30% of its GDP value through trade. As such, the US trade chart would look almost identical to the world chart below, but at only half the value. The relative importance of trade between the US and the rest of the world is likely the argument upon which the Trump administration bases it’s sentiment that the US has leverage to re-negotiate our trade deals.

Chart 2 – Trade as a % of GDP

Source: World Bank

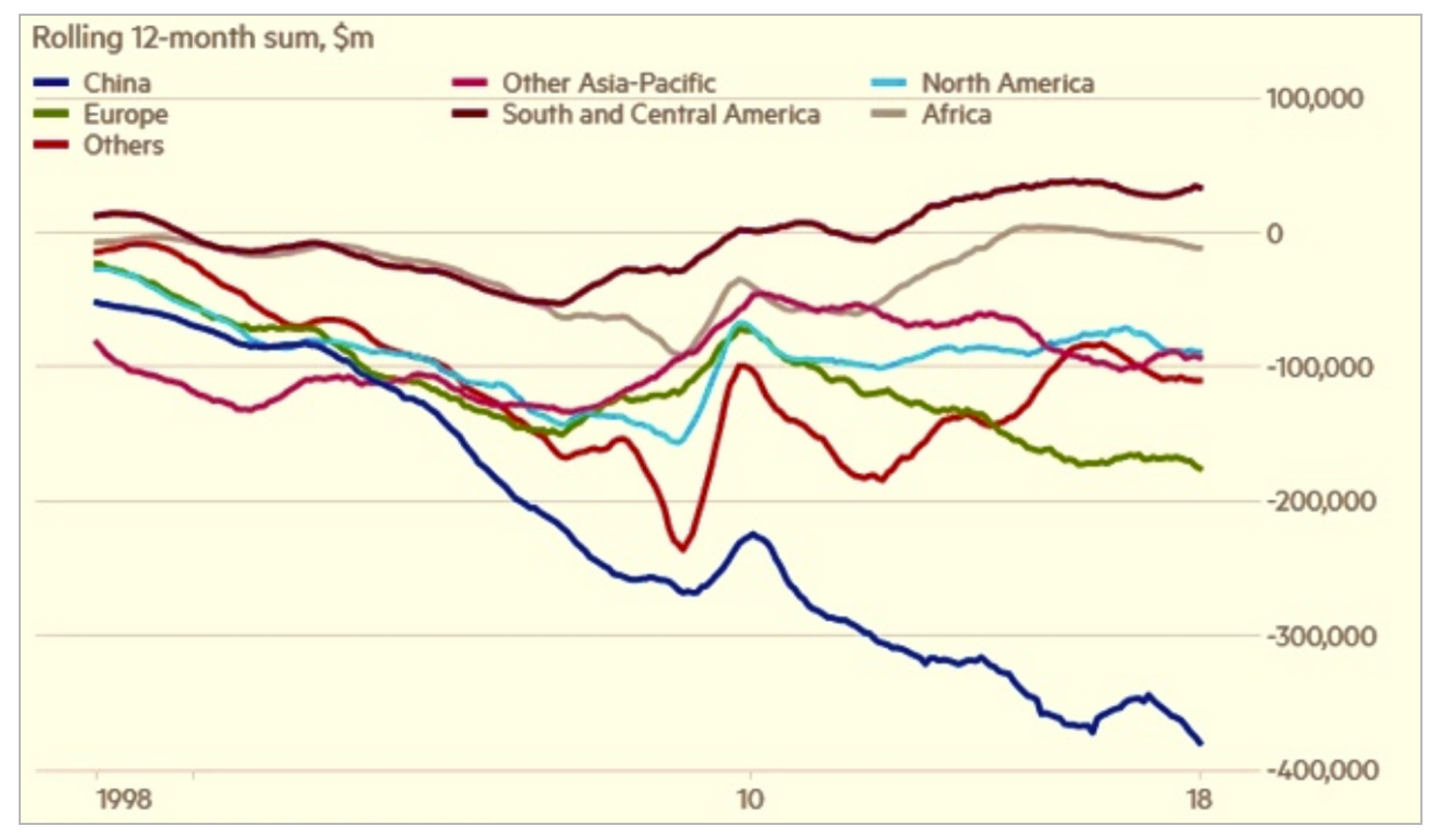

The final illustration (Chart 3) shows the relative contribution of specific countries and regions to the US trade deficit. To put those combined levels in context, the US total current account deficit is only 2.4% of our $20T GDP. Historically, our current account deficit has averaged 2.6% since 1980.

Chart 3 – US Goods Trade Deficit

Source: Thomson Reuters Datastream

Specific Regions

NAFTA- Our North American trading partners, Mexico and Canada, combine to form the largest trading partners for the US at ~25% of total trade. Yet, these countries only represent ~10% of the total deficit. This agreement has arguably been a net positive for all three countries.

China- In contrast to our North American trade partners, China represents only about ~15% of total trade, but that 15% represents 50% of our total deficit. This is the one area where the US is on firm ground to push for more balance. Protecting intellectual property (IP) rights for our high tech sector within China is another area where the US should push, and hard!

EU- Our deficit with the EU is actually quite small, when considering the relative size of the two trading partners. This surplus/deficit represent less than 1% of each partners’ total GDP. When considering the EU is comprised of 28 countries, the relative potential gain of imposing tariffs is quite small.

*Germany– The one issue that stands out underneath those headline EU numbers is that over ⅓ of our deficit with the EU is with Germany alone. As such, any tariff talk involving autos and the EU will primarily target and affect Germany.

Is This A Fair Bake-Off?

Before getting into the big picture issues of trade and the potential impact of tariffs, it is important to state that this topic is very complex. We will not attempt to dig into all aspects that drive our trade imbalances nor the fairness of each of those imbalances. Suffice it to say that there are numerous cross-currents woven into all US international trade agreements.

Before moving forward, let’s compare weighted average tariff levels for some key countries/regions in this discussion:

US – Applies tariffs of 1.6% on imports. This is low, but not the lowest amongst developed nations. The US experiences tariffs of about 4.9% on average for its exports.

EU – Also applies tariffs of 1.6% on imports. The EU experiences an average tariff of 3.5% on its exports.

“Protecting intellectual property (IP) rights for our high tech sector within China is another area where the US should push, and hard!”

China – Applies tariffs of 3.5% on imports, which is actually comparatively low for a developing country. However, the tariff rate on US goods is closer to 10%…that’s a problem that needs to be addressed. China faces tariffs on its exports that are in line with those of the US, at ~4.9%.

But tariffs are just part of the story and even the numbers cited above can be manipulated to create varying narratives. Another angle to this story includes counting all the various components of protectionist measures…highlighted below.

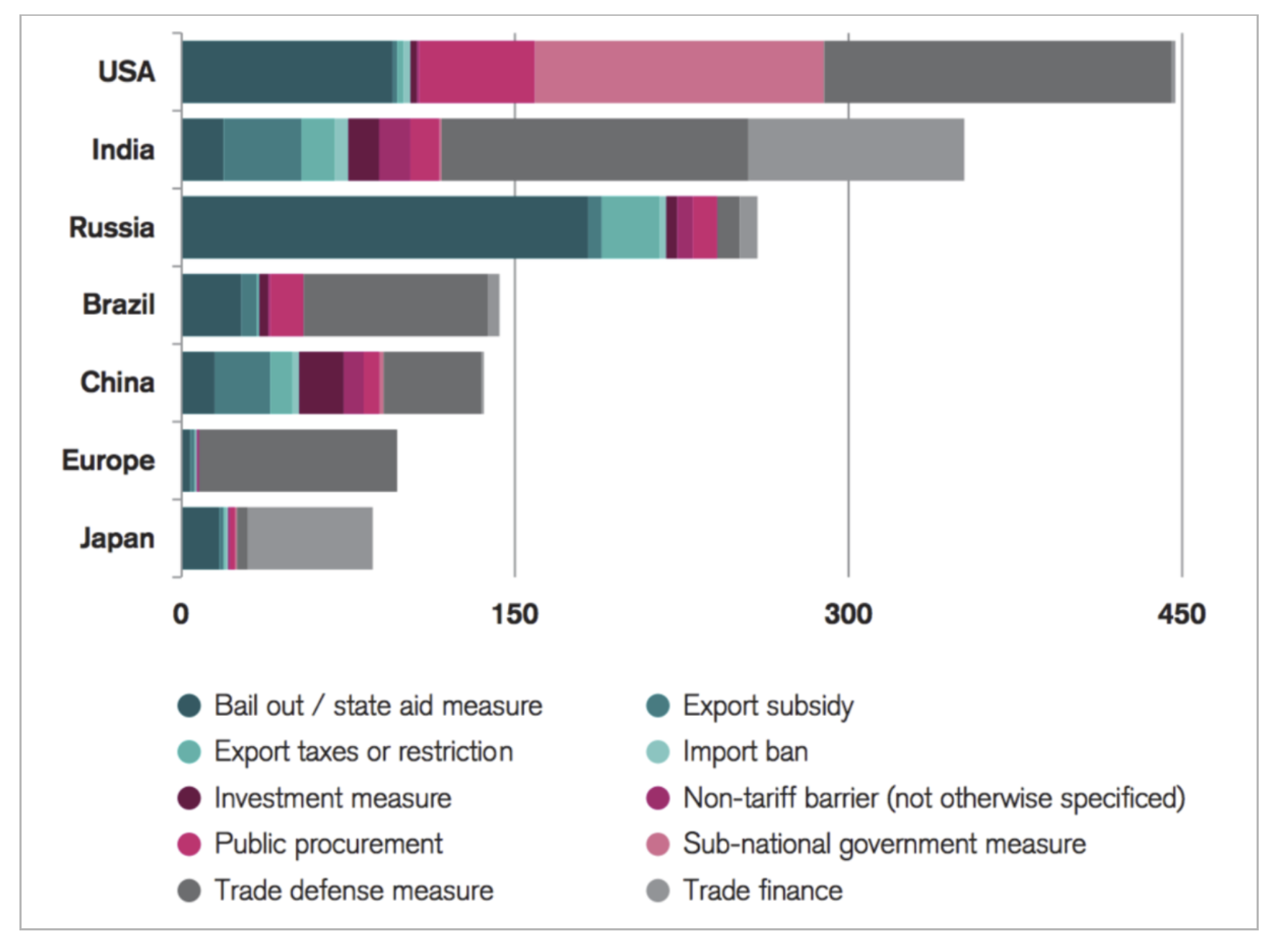

Total Protectionist Measures by Country

Source: Global Trade Alert, Credit Suisse

Once again, I caution that these measures are viewed through a specific, albeit wide-angle lens, but they do show the US is not being obviously disadvantaged in a systematic fashion.

That said, the US and the world are on very stable footing in pursuit of Intellectual Property protections within China. The US and our allies should have a strong case if they work together through the WTO to make that happen rather than acting out unilaterally.

Keeping the Oven Light On: Trade Issues we are Watching

We will now attempt to handicap the relative importance of the current primary trade issues and the corresponding potential impact on the economy and markets.

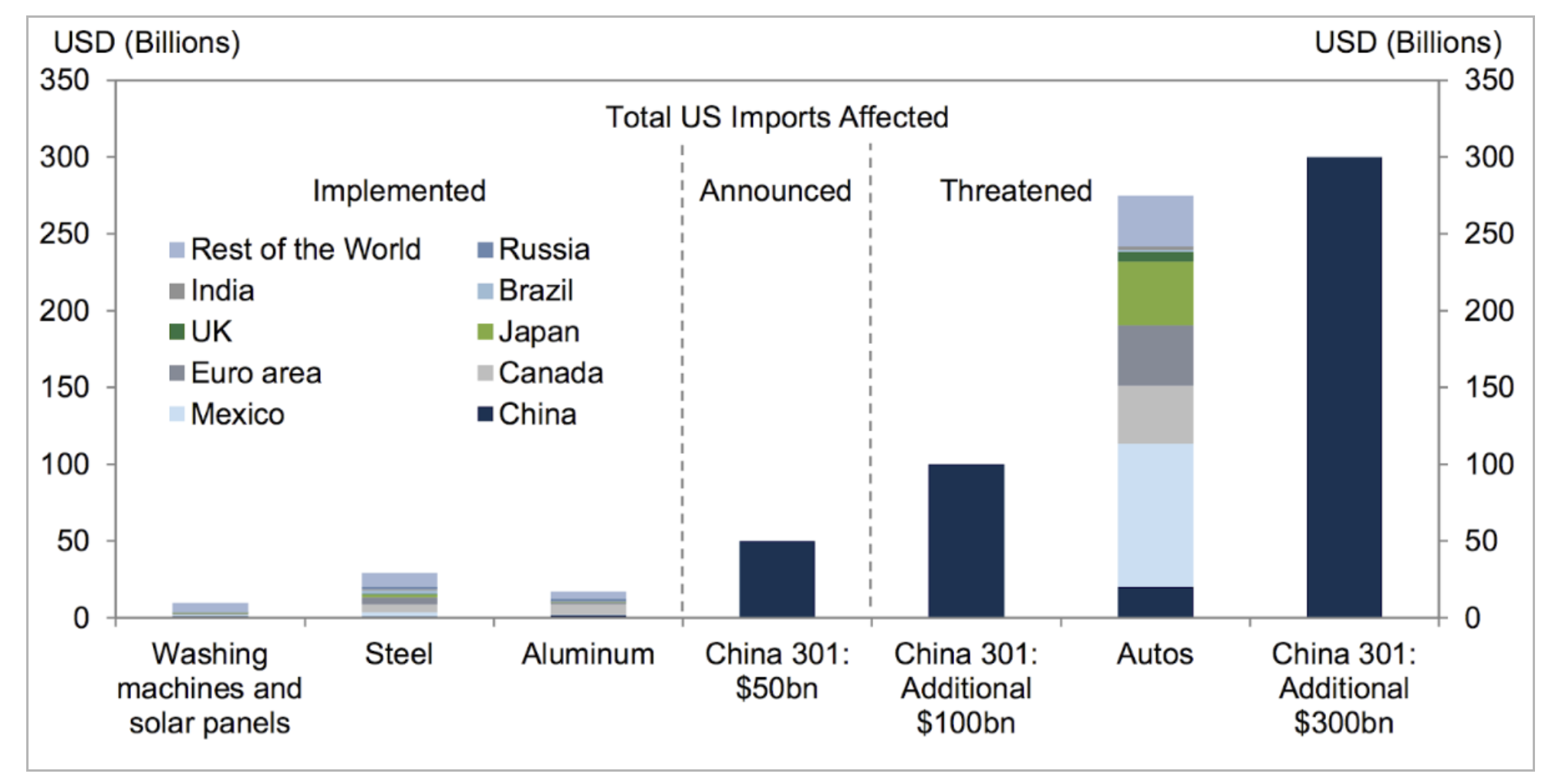

The chart below shows graphically the tariffs that have been implemented and/or threatened to date (July 10th, 2018).

Threatened, Announced, & Implemented Tariffs

Source: USITC, Goldman Sachs Investment Research

Current Playing Field

So far (as of July 17th, 2018), the US has implemented steel and aluminum tariffs (which total ~$50B) along with tariffs targeted to hit Chinese manufacturers of solar products and washing machines, plus another ~$50B of Chinese products. The net effect of this initial round is miniscule.

In fact, if all the currently discussed tariffs (including China and the EU) are enacted and retaliated at full force, we are still only talking about a total of ~$800B in products going each way. Goldman Sachs estimates this will only amount to -0.2% decline in US GDP and +0.2% increase in inflation. The risk to the global economy is a bit more substantial.

The markets will respond negatively if the impact appears large enough to nudge a large trading partner into recession and de-sync the global recovery.

Risk of escalating – Moderate. Risk to economy – Moderate.

Auto Tariffs

If tariffs directed toward the EU extend to autos, that will not sit well. Germany and others will feel forced to retaliate – hard. This action will most certainly introduce volatility into the market.

That said, it is very difficult to determine exactly where a car is sourced and manufactured. It is even less clear how best to track the impact of tariffs throughout this industry. One thing is for certain, the auto industry are not fans of any sort of change that impacts their supply chains. GM is on record clearly stating that tariffs will lead to higher costs and loss of jobs.

The economy can handle the tariffs, but the bigger risk is erratic policy and the resulting impact on the market.

Risk of escalating – Moderate. Risk to economy – Moderate.

China Policy

China – this one could sting! I say that because the Trump administration actually has some solid political and business support behind sticking with this issue.

Newly imposed tariffs on Chinese products are only $50B, which is insignificant for the $14T economy. However, the table is now set for a retaliatory ‘tit for tat’ environment, which could lead to escalation with no real winners. Even if the implementation of those tariffs grows to the currently suggested $250B level or even $500B as threatened, we will still experience more bark than bite.

By the numbers, $500B represents all of the exports China sends to the US, while the US only exports about $150B to China. This is probably why the current administration believes the US has leverage.

“China was a key player in getting North Korea to the negotiating table and they could reset that table at anytime. No pie for you!”

For now, suffice it to say that total Chinese exports to the US are less than 5% of their GDP. Any and all US tariffs will almost certainly draw retaliation, while not significantly denting the Chinese economy. In fact, US automakers represent 6 of the top 8 car brands sold in China. Based on GM’s initial reaction, a soft ban on US autos could turn this into a net positive for Chinese auto manufacturers.

These tariffs would also put upward price inflation pressure here at home. The political fallout of applying excessive tariffs on Chinese goods will likely precipitate an extended negative tone to the markets, which could create a buying opportunity.

Risk of escalating – High. Risk to economy – Moderate.

NAFTA

If the US ultimately dissolves NAFTA, the impact to the economy could be even more substantial. Canada and Mexico combine to create our largest trading block. Re-negotiating a multilateral agreement into bilateral agreements will lead to higher prices and slower growth on the margin.

Trade with these two countries account for ~7% of total US GDP. Without knowing what would replace NAFTA it is difficult to present estimates, but consensus indicates a -0.5% decline or more in US GDP and an increase of +0.2 to 0.4% in inflation. This scenario would probably not trigger a recession, but could provide a buying opportunity in the equity markets, as long as the geo-politics remain civil. That’s a big IF.

Risk of happening – Moderate. Risk to economy – Moderate.

The WTO “The Whole Pie”

Lastly, and this is the BIG one – there are rumors that the US may pull out of the WTO. Treasury Secretary Steve Mnuchin has denied these rumors, but the administration has been known to reverse course on substantive issues without warning, and we can’t ignore this possibility. It should be noted that this course currently needs congressional approval; however, as the linked article mentions, the administration may be looking for a work around.

“This is the BIG one – there are rumors that the US may pull out of the WTO.”

In our opinion, this would be the worst case scenario and ultimately lead to a market reset and asset reallocation. This action would no doubt introduce maximum uncertainty into the global markets and markets do not like uncertainty. The impact of the US pulling out of the WTO could ultimately impact diplomatic alliances.

Risk of happening – Moderate. Risk to economy – HIGH.

We will be watching closely for this potential outcome. If the US does pull out of the WTO, we will be back to explain why this will not be a repeat of Smoot-Hawley and a global trade war that contributed to the Great Depression of the 1930’s.

Blind Taste Test – Review

In summary, the markets can handle the first four scenarios discussed above with varying degrees of indigestion and opportunity. Pulling out of NAFTA makes the least sense, while looking to freeze the deficit with China and make progress on IP rights has the most support and makes the most sense.

Our largest risk is a path that leads to the complete dissolution of multiple global trade agreements, starting with the WTO. A breakdown in global trade patterns would likely impact geo-political alliances and have broad reaching repercussions throughout the global economy.

The Geo-Politics of Trade

It is difficult to discuss global trade and the potential risks to the preservation of the WTO, without touching on geo-politics. Relations with many of our allies are strained, as the current administration has already shown a willingness to pull out of multilateral agreements; withdrawing from TPP, the Paris climate accord, the Iran nuclear deal, and most recently, the UN Human Rights Council.

President Trump recently tweeted that the “UN is as bad as NAFTA”, while stirring up tensions with our allies at the June G-7 meeting in Canada. In response, after President Trump visited NATO in Brussels on June 12th, EU President Tusk stated “Dear America, appreciate your allies, after all you don’t have that many.”

President Trump also recently lumped Russia, China and the EU in a similar grouping as “foes” that look to take advantage of the US. That can’t be comforting to our allies, and in fact, following the recent Putin/Trump Helsinki Summit, that comment has elevated concerns throughout Europe. These diplomatic steps and missteps by both sides provide a sobering backdrop to the ongoing trade discussions.

Staying with Helsinki, many suggest that Russia likely attempted to lay the groundwork for eventual dissolution of NATO and the WTO during the Putin/Trump private conversation at their July 16th Summit. These outcomes will not come easy, but seem to represent the momentum of the current course.

“These diplomatic steps and missteps by both sides provide a sobering backdrop to the ongoing trade discussions.”

If the aforementioned mentioned rumors are true, and the US does pull out of the WTO, China will likely follow. This path is still marginally unlikely, but represents the politics that could spring forth once alliances have frayed and Pandora’s Box has been opened.

On another front and getting back to how China could retaliate, despite having such a lopsided trade surplus…China could counter higher tariffs by banning the sale of Rare Earth Elements to US high tech firms. China currently mines ~90% of the world’s production of these 15 critical elements, so this could develop into a major issue.

Another potential “behind the scenes” tactic on the political front is that China could (and may already be looking to) scuttle denuclearization negotiations between the US and North Korea. China was a key player in getting North Korea to the negotiating table and they could reset that table at anytime. No pie for you!

Lastly, for the past two years China has supported their currency (the Yuan) through the use of exchange controls. If they once again allow capital to flow out of the country, their currency would depreciate, thus making their products more competitive and thereby offsetting the impact of US tariffs. We haven’t even mentioned how China is the largest foreign owner and purchaser of U.S. Treasury bonds….they buy our debt with their current account surplus, which helps to keep our interest rates low.

I hope these examples highlight how complex these issues can be and how easily we can find ourselves in a lose-lose situation.

The Secret Ingredients

Before finishing up our trade deficit discussion, I want to touch on some very important issues that many economists believe more directly impact our trade deficit than tariffs or other protectionist measures.

“The US economy is heavily skewed toward consumption and away from savings. Our trade deficit will not materially change until that chronic trend reverses.”

It is important to note that the US has historically had a “strong dollar” policy following the Bretton Woods conference in 1944. Bretton Woods helped move the global monetary system from the gold standard to positioning the US dollar as the premier global reserve currency.

All things equal, a consistently strong currency leads to a chronic trade deficit, because a strong currency makes our products more expensive to overseas buyers, while making foreign products more of a bargain to us. This currency effect helps explain our historical and current trade deficit.

Taking that a step further, most economist agree that a trade deficit isn’t even a bad thing, especially for a country that runs budget deficits. In fact, trade deficits are not particularly tied to trade or competitiveness, but rather other macro economic factors.

Which brings us to what I believe is the most important point on this trade imbalance topic, and I can’t overstate its role… the US economy is heavily skewed toward consumption and away from savings. Our trade deficit will not materially change until that chronic trend reverses.

As such, any gains to be made to the trade deficit through tariffs are likely small compared to any potential impact of structural changes to our consumption/savings rates. Period.

Let me say that again…PERIOD!

The Last Slice

Looking back through history, it is clear that global trade has been a net positive for the domestic and global economy by spurring growth and helping to suppress inflation.

Those lower inflation rates allow for lower interest rates, which can attract more investment that can lead to higher productivity and subsequently higher growth. It is indeed a virtuous circle. In fact, some research indicates that the free trade policies of globalization are actually linked to technological innovation.

We are now in the early stages of considering the impact of the Trump administration’s trade policies on the global economy going forward. At this point, the expected economic impact from each flavor of potential trade dispute appears challenging on both the growth and inflation fronts. Yet, most of these outcomes are manageable, albeit unsavory.

Hopefully this is just a negotiating tactic to help the US “get a better deal” and can still be scaled back or reversed. Much of that will depend on the political calculus heading into the midterm elections. We still suspect this is more bark than bite.

Let’s just hope we don’t end up getting a bigger slice of a smaller, more expensive and less tasty pie.

EXTRA CREDIT: For those of you that are truly curious, here is a link to a paper that explains why “globalizers” grow faster than “non-globalizers”.