HOW LOW CAN YOU GO?

Global Interest Rates Are at All-Time Lows.

Here are Ten Reasons You Should Care.

Interest rates around the world are so low, it is as if they are playing limbo with gophers who can go subterranean, or in this case negative. Is that a good, bad, or just a strange thing? We will look at all aspects of this question in this month’s edition of “Cutting Through the Noise”, as we provide our Top Ten Thoughts on Ultra-Low to Negative Interest rates.

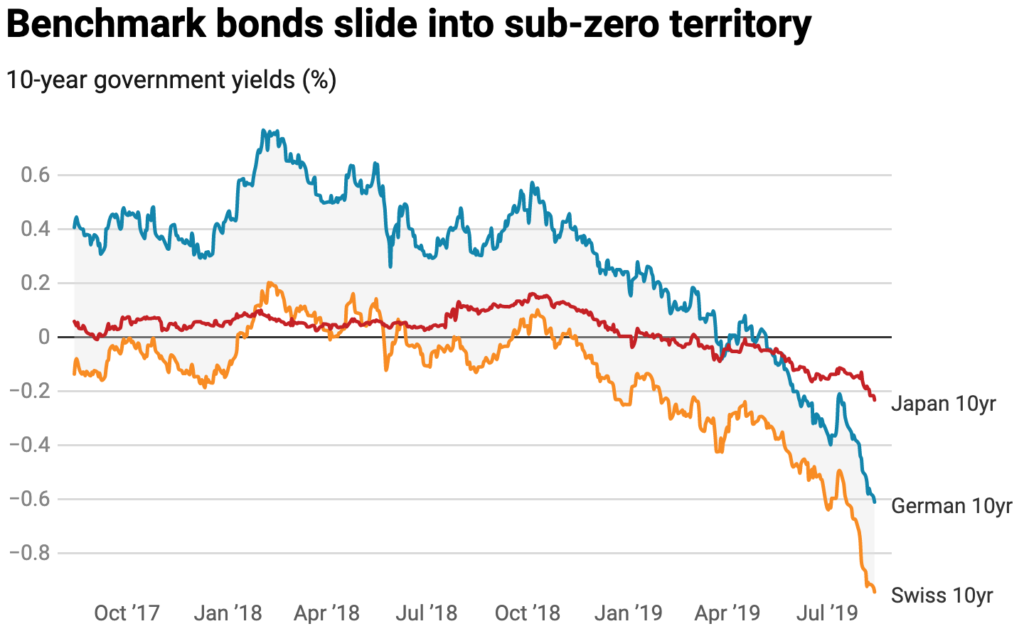

The progression and current state of global interest rates over the last two years is perfectly illustrated in the single graph below:

Investors in Europe and Japan are stocking up on mattresses and mason jars…

If you are looking at this graph and thinking something looks strangely out of place, congratulations you passed the test! Major global government yields have now gone negative. Who buys a bond that pays a negative interest rate? Give them $100 for the right to get $92 back in 10 years? Ummmmm, no thanks. Shouldn’t I just lock my money in a safe?

Great questions! It turns out the biggest buyers of negative yielding bonds are index funds. Why?…because they must. That is their charter. Index funds invest a pro-rata share across their specified universe, typically utilizing a market capitalization weighting scheme. That means when it comes to bond index funds, the bond issuers with the most debt get the biggest weight. Negative yielding bonds now total over $17 TRILLION and comprise approximately 30% of the entire global bond market. Therefore they represent a similar share in many bond index funds. This is why active management makes sense in the bond investment world.

If learning that index funds can lead investors to blindly purchase negative yield bonds makes you uneasy, then this article by Michael Burry, of “The Big Short” fame, will keep you up at night. Michael is on record, saying that index funds are the new CDOs (Collateralized Debt Obligations). You remember CDOs… the derivative bond instruments that almost destroyed the global economy back in 2008-2009. I wouldn’t go as far as comparing the current state of the index market to the CDO market during the Financial Crisis, but our 2018 article sure did highlight most of the same warning signs that Michael is now trumpeting.

Getting back to negative yielding bonds – we have now spun 180 degrees from believing QE (Quantitative Easing) activities will cause rampant inflation, to now fearing the resultant and artificially managed low interest rates may presage a deflationary freeze.

10 Thoughts on Negative Interest Rates

1. Pick your enemy… Central Banks would rather fight inflation than deflation!

There is a wide range of potential outcomes from negative interest rates. The consensus view is that the negative interest rate path may be necessary to avoid deflation AT ALL COSTS. Central Banks know how to tame inflation, but downward spiraling prices bring many more unknown risks. Think of this struggle as the “Devil you know vs. the Devil you don’t know.” Central Banks want (NEED) to stay ahead of deflation.

For what it’s worth, China is already “exporting deflation.” This is a huge issue and it complicates matters for global Central Banks. For now, understand that the Chinese government seems satisfied to fight the trade tariffs through a weaker currency, as they mark time until the next US Presidential election. This move helps to further drive down costs and ergo, export deflation. There is a lot more nuance to this issue; this is the “Cliff Notes” version.

2. Is it time for more Fiscal Policy?

Fiscal policy, like lower taxes and/or higher budget deficits, would likely be the more effective route to fighting deflationary forces, as opposed to monetary policy, which offers ever lower interest rates. However, that approach was tried (Tax Cuts and Jobs Act of 2018) and resulted in historically high budget deficits and debts. This route won’t be an option in Europe, with Germany anchoring (and policing) the Euro. The Germans have consistently balked at allowing leeway for other Euro countries to take on higher deficits to offset budget constraints.

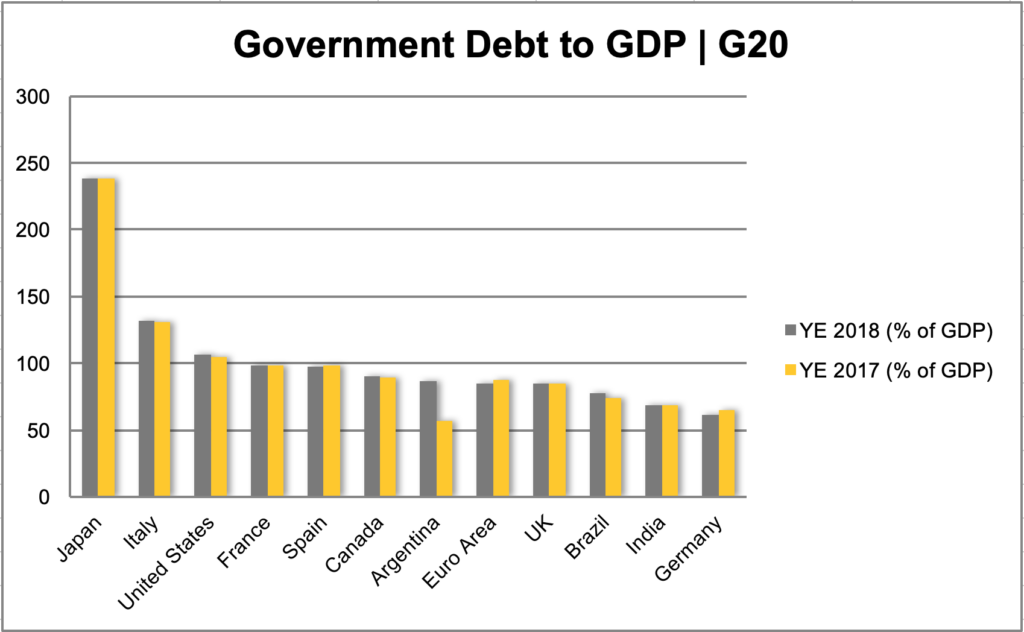

You may remember a highly debated report by Rogoff and Rhinehart following the Financial Crisis, which stated that when total public debt meets or exceeds the GDP, the economy will reach a tipping point. Clearly, Japan has been able to withstand levels far above this for sometime (although they have endured other issues). The bar chart below shows that the US has now moved toward the top of the charts and pierced that infamous 100% barrier. There is not much wiggle room available through taking on additional debt!

3a. Low to negative interest rates crush savers and people on a fixed income

Low returns on savings ultimately hurts consumer spending. This is the “Japan-ification” effect taking root around the globe. So far, negative interest rates have spread to Europe. Based on demographics, the US is in better shape than the rest of the developed world (including China) on this measure, but we may not be immune.

A consequence of these super low interest rates is that pension funds will need to take more risk to meet their obligations. Risks eventually come up empty and could lead to retirement fund shortages. The National Bureau of Economic Research recently claimed that retirement plans are at least 10 years underfunded, based on expected rates of return and life expectancies. This reality is only getting worse the longer rates stay negative (inflation adjusted).

3b. Super low interest rates would not be possible without super low inflation

Technology/innovation and globalization are two secular forces pushing inflation lower. Aside from higher temporary inflation from tariffs, this trend appears entrenched. We need to forget about the runaway inflation of the 1970s. That period has led to more bad investment decisions through time than any other event in our lifetime. We need to be prepared for deflation and the impact this will have on asset prices.

4. Interest rates reflect the price of money

Just like all prices, interest rates are based on supply and demand. Low to negative interest rates are symptomatic of a lack of growth opportunities and lack of demand for financing. When interest rates are below inflation, that is abnormal and suggests there may be an excess supply of productive resources that must be cleared or replaced.

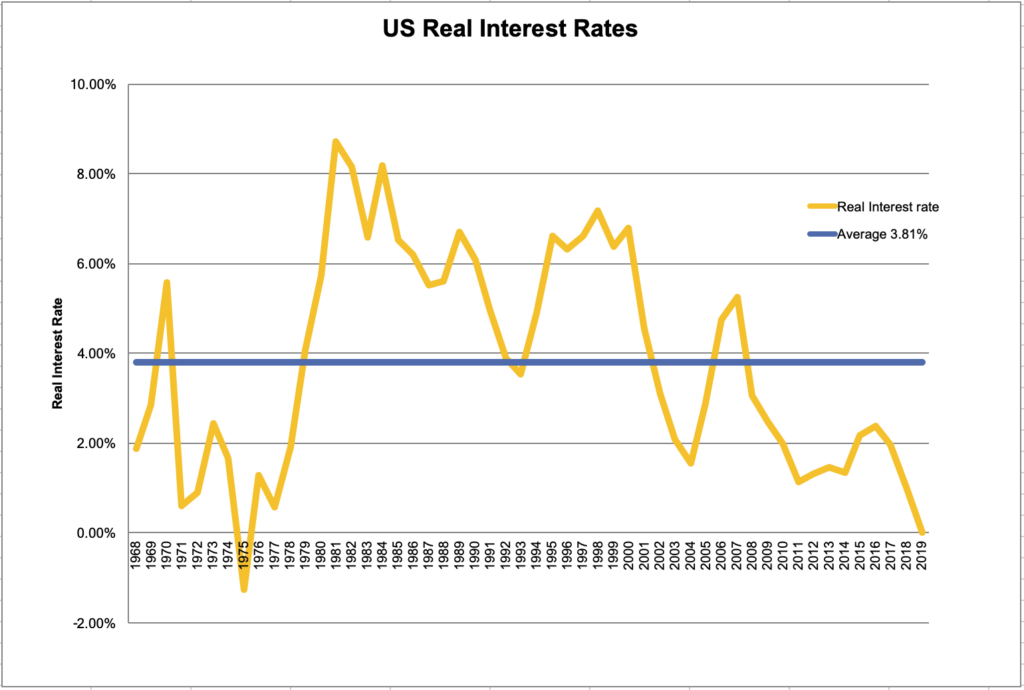

The chart below illustrates what has happened to real interest rates from 1968-2019. Real interest rates are defined as (interest rate on 10 yr UST, minus inflation rate used as the GDP deflator). Over that roughly 50 year period real interest rates offered a 3.8% premium over the rate of inflation. Real interest rates are currently 0%. The only other time this happened was briefly in the 1970’s when we had rampant inflation related to the oil shock and Vietnam War debts, both hitting as we went off the gold standard.

Zero to negative real interest rates imply there is not enough demand for capital, or said differently, there is a dearth of profitable opportunities. This piece by Mohammed El-Erian indicates that negative interest rates would be a disaster in the US.

5. Negative interest rates will lead to asset bubbles

Some banks are offering negative yield mortgages. That is not a good thing. I was recently in Copenhagen and noticed the property values there are on par with those in SF. This seemed strange, because while their economy is doing OK, they certainly don’t have the growth engines for wages and profits that we do here in the Bay Area. Also, while we do not feel like we live in a tax haven, we do have it better than most Scandanavian countries on that score.

Well, a little deeper dive and you see what impact ridiculously low interest rates can have on housing prices. We need to remember interest rates can cut both ways. And what the market giveth, it can taketh away with just the slightest back up in rates triggering an unwinding of debt.

6. Low interest rates helps finance treasury debt – this is actually a positive!

For example, the US government currently has total debt of over $23T. The interest on the debt is about $500B or 10% of the Federal budget.

To put those numbers in perspective, mandatory spending is about 64%, military spending is 15%, non-military discretionary spending is 12%. So lower interest rates can actually make a significant difference in the federal budget.

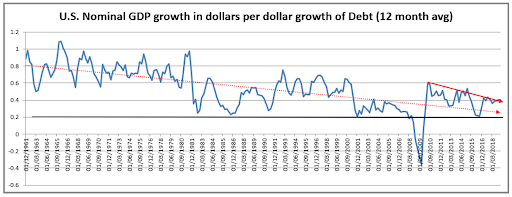

The question is if these low rates will spur productive spending or will they spur inefficient spending, crowding out private investment? At present, as the chart below displays, the return on each $1 of debt is about $.20 to $.40 of GDP. That means debt is not coming close to paying for itself.

7. Low interest rates overseas = low interest rates in the US

Low global interest rates overseas will keep downward pressure on US rates due to overseas liquidity flowing to higher yields in the US. That is why they call it liquidity…it flows like water and will flow downhill and find the lowest bond prices, which produce the best yields. For example, can you believe a US Treasury bond currently pays a higher interest rate than a Spanish corporate bond? Let that sink in a bit.

In any event, tariffs will lead to more insular economies, which could damage this global yield-seeking relationship and cause temporary unexpected inflation around the globe, which could lead to less free flowing capital. Mind you, the inflation from tariffs is not the good inflation that arises from higher growth, but more like a tax with no benefits. It is not clear if higher inflation from tariffs, and subsequently higher yields, will ease or exacerbate the global negative yield conundrum. Our guess is that a tax with no benefits will likely lead to less efficient deployment of capital and only worsen the situation.

8. Banks are at an extreme disadvantage, if rates stay low and the curve stays flat

The business model for banks is to borrow short and lend long. As such, in this environment, the banks borrowing costs are higher than their fee revenue. That leads to an unprofitable banking sector, which leads to an unhealthy economy. There are long term risks to the economy, if banks do not have incentives to loan.

This doesn’t get mentioned much, but the reason an inverted yield curve often pre-dates a recession is because banks are disincentivized to make loans in this environment because their borrowing costs barely cover their lending fees after loan loss reserves. Therefore, if banks aren’t making loans, the economy will not grow and will eventually decline. European and Japanese banks are a model for where this could be heading.

9. When inflation is higher than interest rates, the impact is the destruction of our productive asset base.

This is simple arithmetic – when inflation is higher than interest rates, then money is worth less in the future. This can not go on indefinitely or it will lead to an evaporation of capital. There is not enough demand for capital because of risk, taxes, regulation and declining productivity. Hence, the economic landscape will become stagnant.

There are some doomsday economists that believe today’s Central Banks are blowing Europe’s final bubble through their chronic QE programs – enough already! Negative real rates (interest rates – inflation rate) in Europe are a real problem, no pun intended. Germany is currently -2.5% vs -.07% here in the US. This is serious stuff.

More inflation will only exacerbate the problem and accelerate the pace at which our capital stock becomes obsolete. Once again, this is not the consensus view, but it does make logical sense and the results could be disastrous. It is just a matter of how slow that leak occurs and for how long before it attracts attention and sounds alarms.

For now, Japan and Europe are the only sizable countries/regions stuck in this quagmire, but they represent large economies and nothing says they, along with China, can’t drag the US and rest of the world into a global deflationary spiral.

We do not want to see that limbo bar go any lower, especially in China.

10. What else we got?

Let’s face it, negative interest rates are more out of desperation than design. Central Banks are out of bullets. As we survey the situation, this could possibly be managed like QE and be just fine for quite some time, OR it could also lead to the final bubble. Just like QE, which led us to this situation, there is no playbook for this environment. The Fed is writing the manual as they go.

Limbo or High Jump Bar?

Are low rates providing the necessary boost to economic growth, or has the cure become the toxin and now providing a hurdle to making capital investment? That is a very difficult call. The issues are not clear cut, but there are likely forces currently at work either leading to a prolonged recovery or abandoning the idea that each generation will continue to be better off than the last. This negative real interest rate experiment is that important.

There are clearly positive aspects to low interest rates, but too often they lead to more borrowing that does not pay for itself, which then leads to inefficient capital deployment. There are also clear signs that it is possible that we are destroying capital the longer we run with negative real rates.

This is a better time to be risk averse than to stretch for risk. If the US economy can only generate 2.5% GDP with 1.5% interest rates, a host of deregulation, and big tax cuts, then we may be running out of ammo. Additionally, Europe and Japan have even lower rates AND lower GDP, while China is clearly slowing. Yes, we may be getting a bigger slice of a shrinking pie, but is that winning?

When ultra low interest rates still provide too high of a bar for businesses to invest, then something is not quite right.

NOTE: For those of you interested in reading more on the topic, I recommend the Financial Times’ 6 part series on negative interest rates. Not too technical, while providing an overview of the real forces at work. You will need to sign up for access, so I can not provide a link.

Our next edition will discuss a top ten of targeted investment strategies for a low to negative yield curve environment. Time to put on your yoga pants and get ready to L-I-M-B-O!!!